How to find cheap workers' comp insurance rates

Table of contents

- Why is workers’ compensation insurance coverage important?

- Classify your business and employees correctly

- Shop around to find the best business insurance and reduce costs

- How much does a workers’ comp policy cost?

- Consider a pay-as-you-go workers' comp plan

- See if you qualify for a lower premium policy

- Manage your risks to keep insurance coverage affordable

- Where is workers’ compensation insurance required by law?

- States with the most affordable workers' compensation insurance rates

- Industries with the lowest workers' compensation insurance rates

- Get free quotes and buy online with TechInsurance

Why is workers’ compensation insurance coverage important?

As a small business owner, sole proprietor, or independent contractor, one of your most pressing issues is often that of money.

Do you have enough revenue coming in to cover what needs to go out? Specifically, do you have enough revenue to cover essential business expenses like workers' compensation insurance?

This second question becomes especially important when you live in a state that requires workers' comp coverage, or if you receive a contract from a client that requires you to carry a workers’ comp insurance policy with specific limits.

Small business owners find workers' comp insurance is essential for a few reasons:

- Most state laws, such as in California and New York, require workers’ comp coverage as soon as a business hires its first employee (including part-time employees).

- It covers medical care expenses and partial lost wages due to a work injury.

- Most workers' comp policies also cover the cost of employee lawsuits related to a workplace injury.

- Disability benefits and death benefits provided by a workers' comp policy can save a significant amount of money for policyholders and their injured workers.

While sole proprietors and independent contractors are not typically required by workers' compensation laws to carry this policy, many buy this insurance to fulfill the terms of their contract or to protect their income.

Private health insurance will typically not cover work-related injuries, so that's another consideration for small business owners to consider.

Business owners can save on workers' compensation insurance by implementing the following practices.

Classify your business and employees correctly

When you apply for workers’ compensation coverage with TechInsurance, you begin by selecting your industry and type of work your business does. We start here because workers’ comp costs are based in large part on the workers' comp class codes for different professions.

These class codes allow insurance providers to identify customers with high-risk types of businesses, who may in turn be more likely to file a workers’ comp claim for an injured employee.

Depending on how different your employees' tasks are, they may be exposed to different levels of risk throughout the workday. Classifying employees with the correct workers' comp class codes can also help your business avoid overpaying for workers’ compensation insurance.

For example, if you own an energy company, someone who’s installing cables has a higher risk of work-related injury than someone who is running scheduling and whose work can be completed from a desk. Work with your insurance agent to verify that every one of your employees is properly classified to ensure you’re not paying more than you need to for coverage.

Shop around to find the best business insurance and reduce costs

Shopping around and comparing quotes from different insurance companies can save you money, as not all insurance companies offer the same rates.

This step is not possible if you live in North Dakota, Ohio, Washington, or Wyoming as those states limit workers’ comp to state funds. But if you live anywhere else, you can easily compare multiple quotes by applying through TechInsurance.

When you submit an application, we’ll send you quotes from our partner insurance providers that have plans available for you. Then you can compare prices and choose the one that best suits your budget.

We partner with top-rated insurance carriers

How much does a workers’ comp policy cost?

Small business owners don't have to pay a lot for workers' comp, as the cost depends on the size of your business. The average small business pays about $54 per month for this coverage.

Workers' comp insurance costs are based on factors including:

- Number of employees

- How much insurance coverage you need

- Where you do business

- Industry and risk factors

- Payroll

- Type of business

- Coverage limits

- Your claims history

Consider a pay-as-you-go workers' comp plan

To keep costs low and improve your cash flow, you may want to consider a pay-as-you-go workers' comp payment plan.

With a traditional workers' comp plan, you'll likely need to put provide a sizable down payment when you start your policy, typically around 25% of your estimated gross payroll wages. Then, you'll face a yearly audit to adjust for actual costs at the end of your policy term.

A pay-as-you-go payment structure allows you to pay less upfront because, unlike a standard workers' comp plan, your rates are based on real-time payroll and not annual estimates. In addition, it doesn't require such a large down payment (typically only 10%).

Each month, your premium will increase or decrease based on your actual payroll as reported by your payroll service provider. This means you only pay for the workers' comp you're using, and not what you projected.

See if you qualify for a lower premium policy

There are two different types of low-premium policies that a small business owner can pursue: a minimum premium workers’ comp policy, and a workers' comp ghost policy.

Both of these options can help fulfill a contractual requirement to carry a workers’ compensation policy, but the availability of these policies may be dependent on the area of the country that your business operates within.

Minimum premium workers' comp policy

A minimum premium policy is the lowest possible premium that an insurance company will sell a workers' compensation policy for, regardless of your payroll or the amount of coverage.

For small business owners, this could mean that your premiums would remain flat even if you expanded from one to two employees.

Workers' compensation ghost policy

A workers' comp ghost policy is an ideal option for self-employed business owners or contractors with no employees who need to show proof of workers’ comp coverage to either win a new contract or satisfy a local requirement.

This type of policy does not actually provide coverage to anyone and provides no healthcare benefits. It only offers a certificate of insurance (COI).

Manage your risks to keep insurance coverage affordable

Eliminating hazards at your business can reduce the chance of general liability claims and workers’ compensation claims.

By taking effective workplace safety precautions, you can reduce both property and liability insurance costs. Plus, fewer accidents save your business money even beyond lower insurance costs.

An insurance agency may charge more if they think you run a high-risk operation, but you may qualify for cheaper business insurance if you address trouble spots and keep your claims history clean.

Consider a few risk management strategies for your small businesses:

Install security alarms and fire suppression systems

Many insurance companies offer a discount on commercial property insurance for businesses that invest in a central burglar alarm or sprinkler system.

Insurance carriers are particular about what qualifies for a premium reduction. Check first to make sure your upgrade will count for a cheaper policy.

Communicate clearly with clients and customers

An easy way small business owners can reduce the risks of errors and omissions insurance lawsuits is keeping in regular contact with customers.

Make sure you communicate often and honestly with your clients to resolve issues before they turn into lawsuits. If everyone’s on the same page, you’re much less likely to end up in court.

Create a safe workplace

Clean spills immediately, keep walkways clear of clutter, and remove loose rugs and other tripping hazards.

Preventing accidents and incidents can decrease the likelihood of incurring costly medical bills and workers' comp claims. The safer your business is for clients, employees, and subcontractors, the less you're likely to pay.

Where is workers’ compensation insurance required by law?

Each state has unique laws and penalties for workers’ comp. In most states, workers' comp is required as soon as a business hires its first employee.

Other states don’t mandate coverage until a business has two, three, four, or more employees. Texas and South Dakota are the only states where business owners are not required to purchase workers’ comp.

Even when not required by state law, small business owners should strongly consider providing this policy in the event of an employee injury that results in medical expenses, which can become very costly.

Find workers' comp requirements in your state

States with the most affordable workers' compensation insurance rates

Your business location and the state where you operate can have an impact on your workers' compensation rates. While it is not one of the biggest factors, it does contribute to the rate you'll pay.

Here are some states where workers' comp is lower than average:

Workers' comp insurance cost | |

|---|---|

$32 | |

$33 | |

$34 | |

$35 | |

$38 | |

$42 | |

$43 | |

$44 | |

$46 | |

$46 |

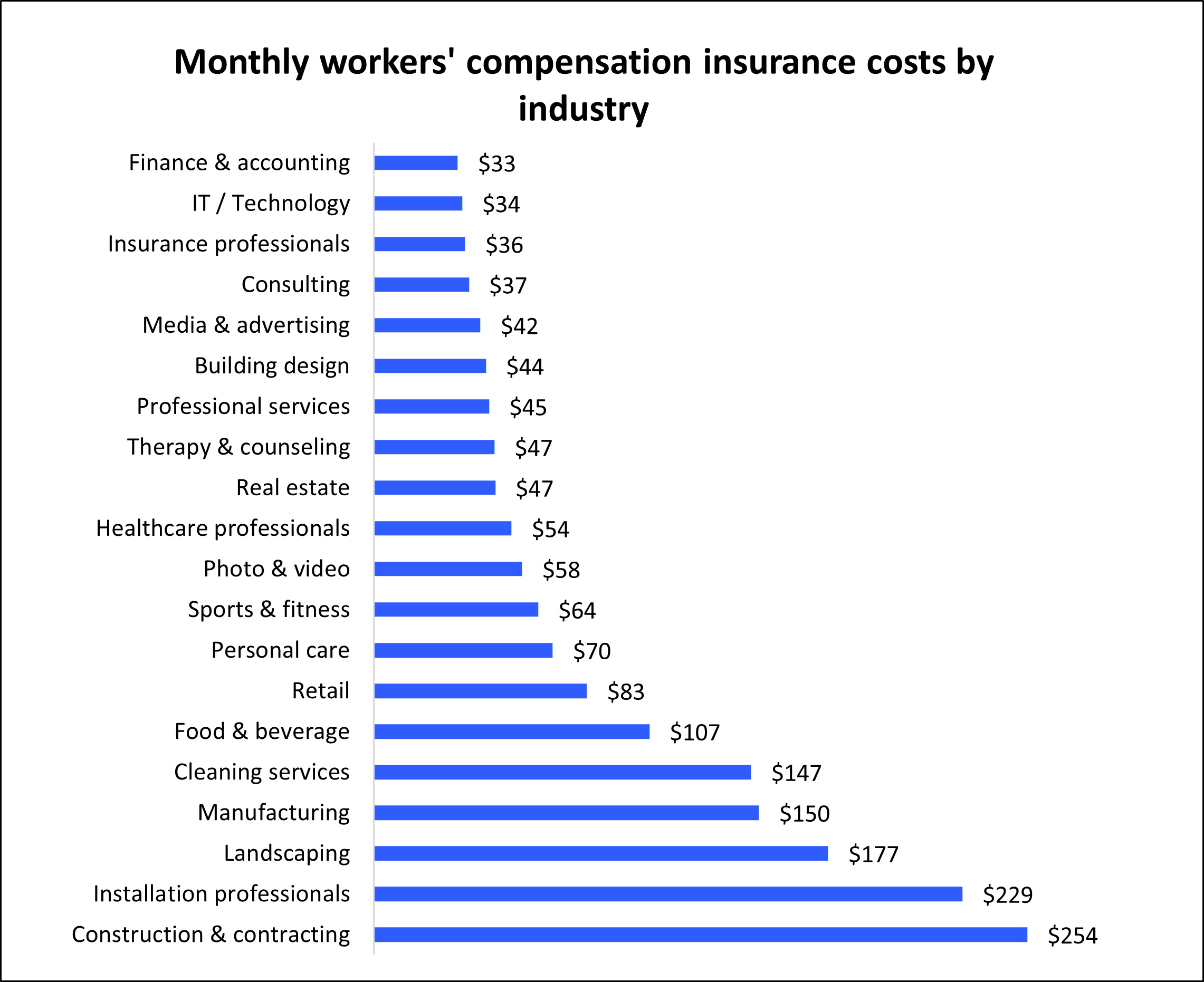

Industries with the lowest workers' compensation insurance rates

Your industry can have an impact on your workers' compensation rates. Industries with higher risks tend to pay more for workers' compensation.

For example, a construction business that regularly faces potentially hazardous risks will likely pay more than an IT consulting firm.

Here's a look at workers' comp insurance costs for different types of workplaces:

Top professions that would benefit from workers' comp insurance

Don't see your profession? Don't worry. We insure most businesses.

General liability insurance

Business owner’s policy (BOP)

Errors and omissions insurance

Cyber liability insurance

Commercial auto insurance

Get free quotes and buy online with TechInsurance

TechInsurance helps tech and other small business owners compare business insurance quotes with one easy online application.

Start an application today to find the right policy at the most affordable price for your business.

You can also speak to a licensed agent about workers' comp benefits or other types of insurance that meet your business needs.