How much does consulting business insurance cost?

If you’re a consultant, your clients, landlords, or state regulations may require you to carry general liability insurance, professional liability insurance, and workers' compensation. These key policies cover unexpected costs that could threaten what you’ve worked so hard to build.

Consulting business insurance costs depend on the size of your company

The bigger the company, the more projects and clients are involved and that means more risk. More risk = the need for more coverage.

However, even consulting companies with just a few employees need more business insurance than independent contractors. Factors include the property you own, from your computers to your office space.

Employees are another reason you need more coverage, since state laws usually require workers’ compensation insurance as soon as you hire your first employee.

General liability insurance costs for consulting businesses

The average cost of general liability insurance for consulting companies is $30 per month, or $364 per year. A general liability policy can pay your defense costs if someone outside your business sues over bodily injury, property damage, libel, or slander. Your landlord, lender, or clients may ask to see a certificate of liability insurance to prove you carry this policy.

Small and low-risk consulting businesses can combine general liability with commercial property insurance in a business owner’s policy (BOP), at an average cost of $46 per month, or $550 annually.

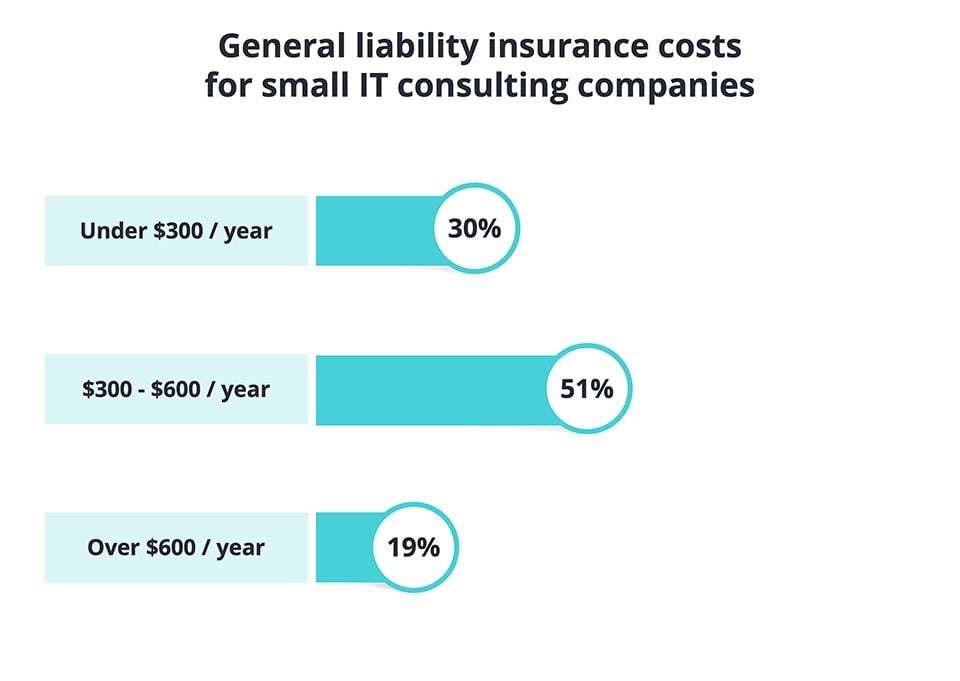

Most consulting companies (51%) pay between $300 and $600 per year for commercial general liability insurance. Companies that interact frequently with clients or customers are more likely to face legal action and may pay more for this coverage.

General liability insurance limits and deductibles

Most small IT consulting companies (83%) choose a general liability insurance policy with a $1 million per-occurrence limit and a $2 million aggregate limit. The average deductible is $500.

The per-occurrence limit is the most your insurance company will pay for a single incident. The aggregate limit is the most it’ll pay during the policy period, which is typically one year. Your insurance provider will pay claims up to your policy limits, which is why higher limits cost more.

It’s possible to save money on your premium by opting for a higher deductible, but make sure you budget for that cost. Your liability coverage will only kick in once the deductible is paid.

Errors and omissions (professional liability) insurance costs for consulting businesses

For companies in the technology industry, professional liability insurance is commonly combined with cyber liability insurance in a policy referred to as technology errors and omissions insurance (tech E&O).

Professional liability / E&O insurance can help pay your legal costs when a client sues over the quality of your professional services or advice. Cyber liability insurance pays costs related to data breaches and cyberattacks that affect your company or a client’s business.

Small consulting companies pay an average of $75 per month or $900 per year for tech E&O.

The more work you do with clients, the more you’ll pay for tech E&O. That’s doubly true if your mistake could lead to a client losing money. For example, companies in charge of cybersecurity may pay more for this policy since a slip up could damage their client’s reputation and cost thousands of dollars in legal fees.

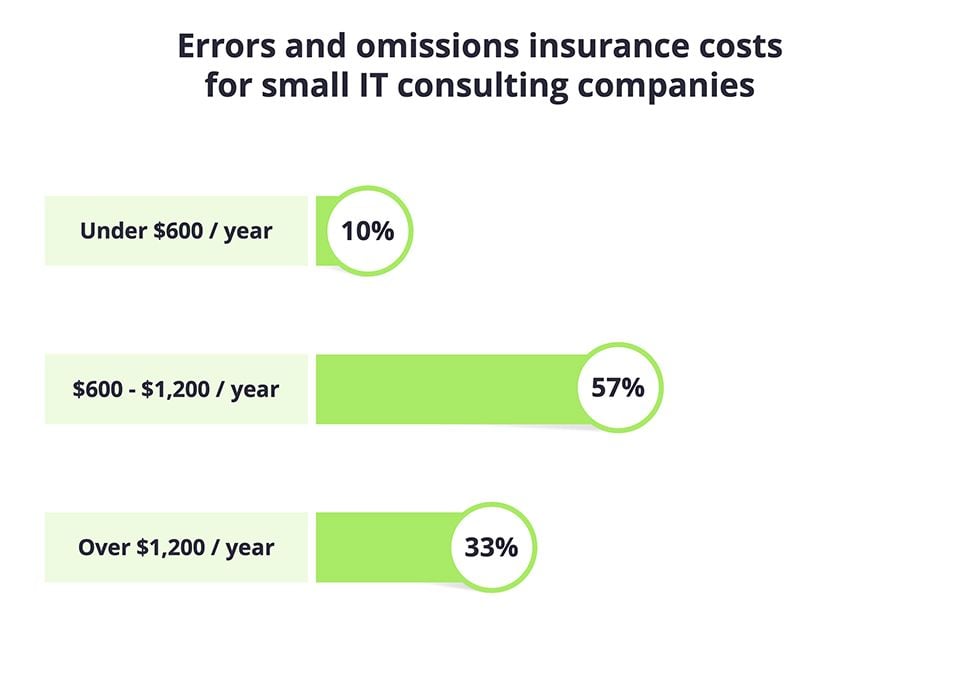

Most consulting companies (57%) can expect to pay between $600 and $1,200 per year for this policy.

Tech E&O insurance limits and deductibles

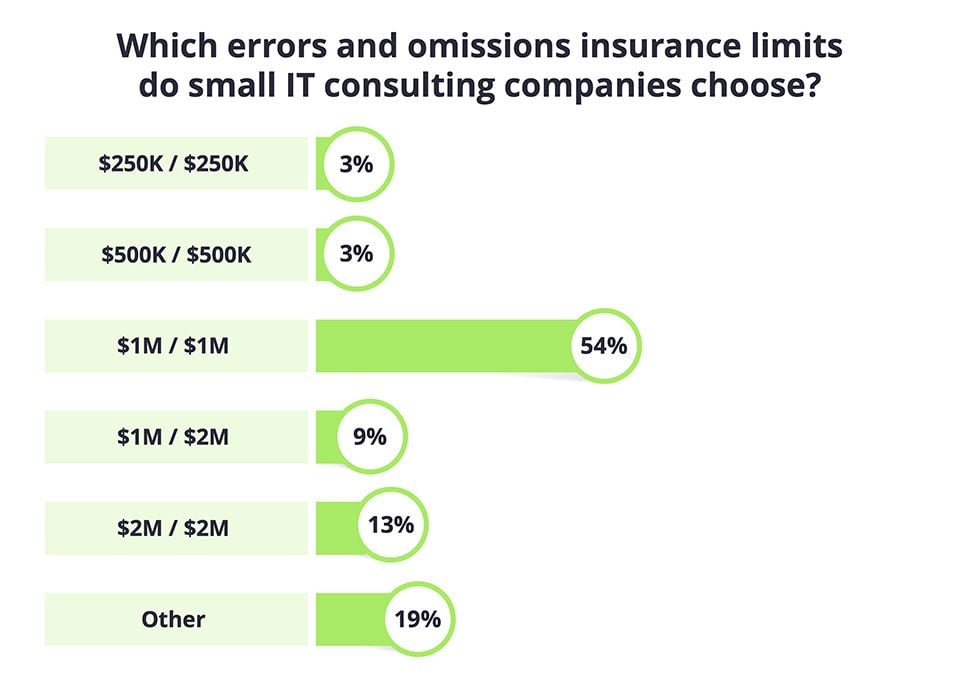

Most IT consultants (54%) choose a tech E&O policy with a $1 million per-occurrence limit and a $1 million aggregate limit. The average deductible is $2,500.

You may want to choose higher limits if:

- Clients depend on your expert advice to increase profits

- You are responsible for clients’ cybersecurity

- You recommend software to your clients

- A delay or mistake on your part will impact clients’ finances in any way

Higher limits always cost more, so don’t buy more consulting insurance than you need. Check with a licensed TechInsurance agent to make sure you choose the right policies.

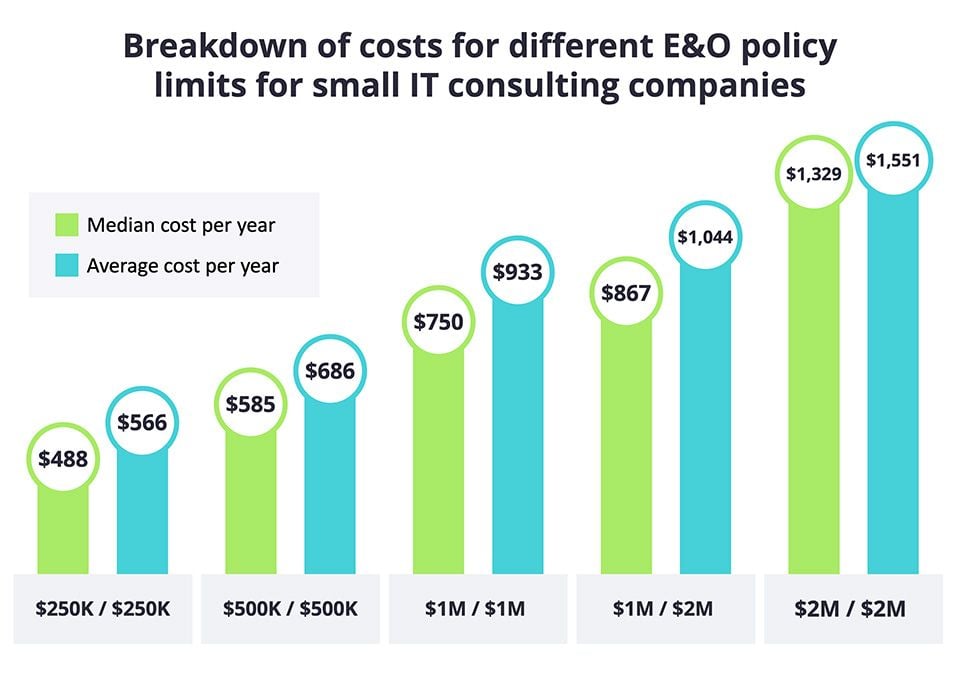

As you can see below, you can pay as little as $41 per month ($488 per year) for a tech E&O policy with lower limits. Or you can pay more to get peace of mind for higher risks.

Depending on the scale and severity of a cyberattack and the cost of data recovery, settlements or judgments could easily top six figures. Evaluate your business risk to determine how much cyber liability insurance you need.

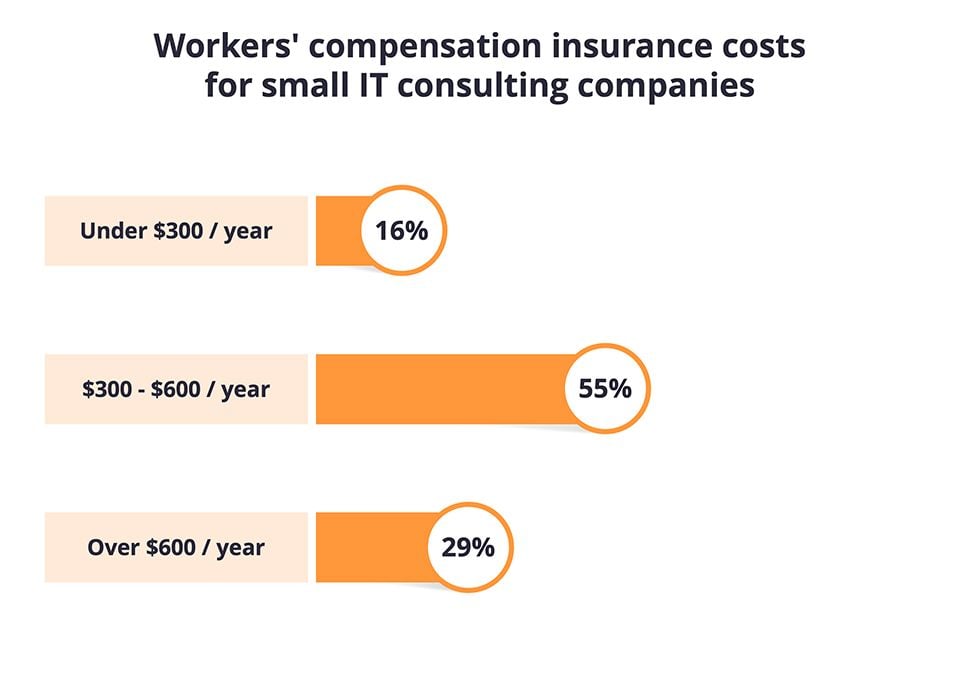

Workers’ compensation insurance costs for consulting businesses

Workers’ compensation insurance costs consulting companies an average of $38 per month or $450 per year. State laws usually require this insurance coverage as soon as you hire your first employee.

Even if your company is small enough that workers’ comp isn’t required, buying workers’ comp is a smart move. If an employee is injured on the job, it’ll pay for their medical bills, wages while they recover, and also your legal costs if they decide to blame your business.

Most consulting businesses (55%) pay between $300 and $600 per year for this policy. The cost depends on the number of employees.

Repetitive motion injuries and slip-and-fall injuries can happen at any tech company. Keeping yourself and your employees safe at work helps you maintain low workers' comp rates.

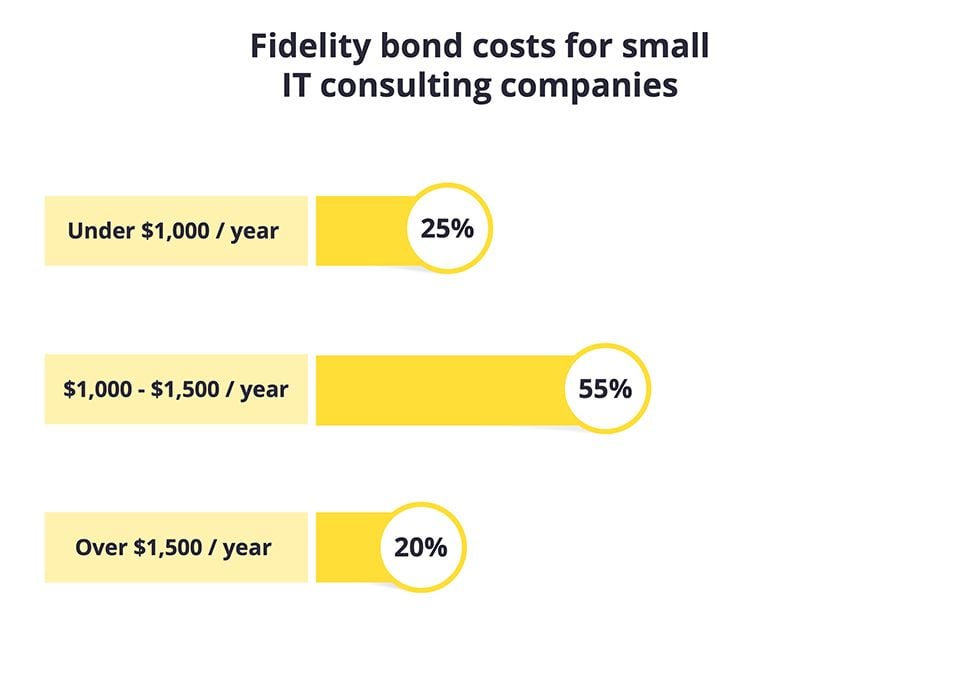

Fidelity bond costs for consulting businesses

Consulting firms pay an average of $88 per month or $1,054 per year for fidelity bonds. Clients often want you to have this coverage, since it’ll compensate them for employee theft. Even though you trust your employees, it proves to your clients that they’re protected from dishonest employees.

Most consulting businesses (55%) pay between $1,000 and $1,500 per year for fidelity bonds.

What do consulting businesses pay for other types of insurance?

View our small business insurance cost overview or find out how much you can expect to pay for common types of business insurance.