How much does cyber liability insurance cost?

The average premium for cyber liability insurance is about $145 per month. Your exact cost will depend on several factors, including the type of data you handle and your policy limits.

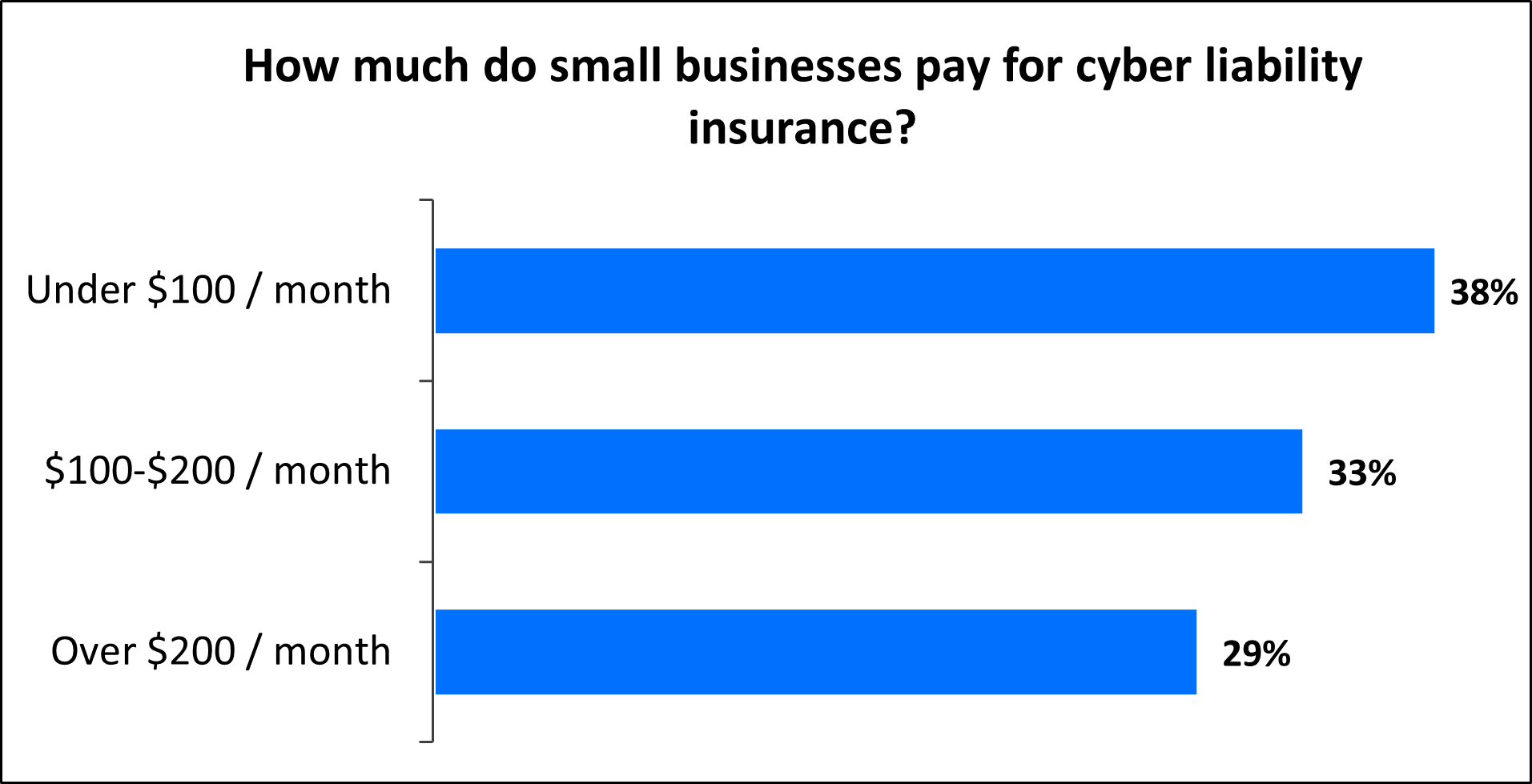

What do small businesses pay for cyber liability insurance?

On average, cyber liability insurance costs $145 per month, or about $1,740 annually, for small business owners. Over a third (38%) of policyholders can expect to pay under $100 for their cyber liability insurance coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

What factors affect cyber insurance costs?

Cyber liability insurance covers the high costs resulting from a data breach or cyber extortion, including credit monitoring expenses, regulatory fines, and legal fees.

When looking into cyber liability coverage, understand that it’s all about scale and risk. Insurance companies consider basics like the size and location of your business. They also weigh additional factors such as:

Amount of sensitive information you handle

The type and volume of data you work with directly affect data breach insurance costs.

If your business stores minimal data, your costs will be low. For example, a small data analysis firm will pay less than a large managed service provider that handles significantly more customer data.

If you’re storing large volumes of sensitive customer data like personal information, credit card numbers, Social Security numbers, or medical records, your cyber insurance policy will cost more as you are at a greater risk for cybercrimes.

The cheapest option isn’t always the best one. Find a policy that will keep your business safe from the slyest cybercriminals and hackers.

Your industry and profession

Your industry and the type of work you do can impact your security vulnerabilities and subsequently lower or raise your cyber liability costs.

Businesses of all sizes and industries process and store some amount of customer data. However, some industries and businesses encounter a greater threat of cyberattacks, phishing, and ransomware attacks to their own data as well as the data of their clients.

For example, an IT consultant, cybersecurity firm, or healthcare facility will likely experience more frequent and intense cyber threats and malware than, say, a landscape designer or a restaurant.

Type of cyber insurance purchased

Depending on your industry and level of risk, you may need additional coverage beyond the standard cyber liability policy to address potential financial losses and legal costs.

Most businesses only need to worry about their own data and their customer data, which requires a first-party cyber liability insurance policy.

If you and your employees are responsible for other businesses' data, you may want to consider third-party cyber liability insurance, which would protect your business if a client sues over a data breach caused by your business.

An example of this is a public relations or other media agency that has access to their clients' private data. If the PR agency were to suffer a data breach due to underperforming cybersecurity measures, their clients could sue them.

A third-party cyber liability policy would protect them from the legal costs associated with the lawsuit.

Third-party coverage is usually bundled with errors and omissions insurance in a package called tech E&O. Learn more about the difference between first-party and third party cyber insurance.

Number of employees with access to sensitive data

It’s a simple numbers game. If more of your people have access to sensitive data, then be prepared to pay more for your coverage. The more access points, the greater the risk of a security breach or successful social engineering attempt. If possible, limit data access to keep insurance costs down.

Your claims history

Any insurance claims you’ve made in the past on your cyber liability insurance policy will likely result in higher premiums in the future.

Your policy limits

How much business coverage do you need? Typical cyber liability policy limits range from $1 million to $5 million or more. If you choose a policy with higher coverage limits, you’ll probably pay higher cyber insurance premiums.

Policy limits include both a per-occurrence limit and aggregate limit. The occurrence limit is the amount an insurer will pay to cover a single claim. The aggregate limit is the total amount an insurer will pay during a policy year.

Depending on the scale and severity of a cyberattack and the cost of breach response and data recovery efforts, settlements or judgments could easily top six figures. Evaluate your business risk to determine how much cyber liability insurance you need.

Deductible you choose

Consider out-of-pocket costs. The deductible is the amount you must pay before your coverage kicks in. Cyber liability policies with $1 million policy limits typically require a deductible of around $2,500.

The cheapest option isn't always the best one. Find a policy that will keep your business safe from the slyest cybercriminals and hackers. Our agents can help you adjust deductibles and limits to fit your needs and budget.

How can you save money on cyber liability coverage?

For full protection, it’s not all about paying more. Learn more about three key ways to keep the cost of cyber insurance down:

Make annual payments

Most insurers let you decide whether to make your insurance payments once a month or once a year. It’s tempting to make monthly payments because it’s more budget-friendly, but you can usually get a discount if you pay the entire premium cost up front.

Bundle policies

Small businesses in the IT sector may be able to bundle cyber liability insurance with their errors and omissions coverage in a technology errors and omissions policy. Generally, this policy costs less than purchasing the coverages separately.

Take steps to improve security measures

Most insurers will evaluate your network security efforts before they insure you. The stronger your security, the less you’ll pay for cyber insurance coverage.

A good risk management plan to lower your cyber risks and your premium include:

- Encrypting files

- Using VPNs and firewalls to prevent ransomware

- Verifying users with multi-factor authentication

- Training employees to follow strict security practices to avoid cyber incidents

- Hiring third-party firms to conduct security audits

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors, consultants, and others, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies based on your business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for cybersecurity insurance and other types of insurance from top-rated U.S. carriers. Our insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.