How much does a business owner’s policy cost?

A business owner's policy (BOP) bundles commercial property and general liability policies at a discount, making it an affordable option for small businesses. The average premium for a BOP is about $57 per month.

What is the average cost of a business owner's policy?

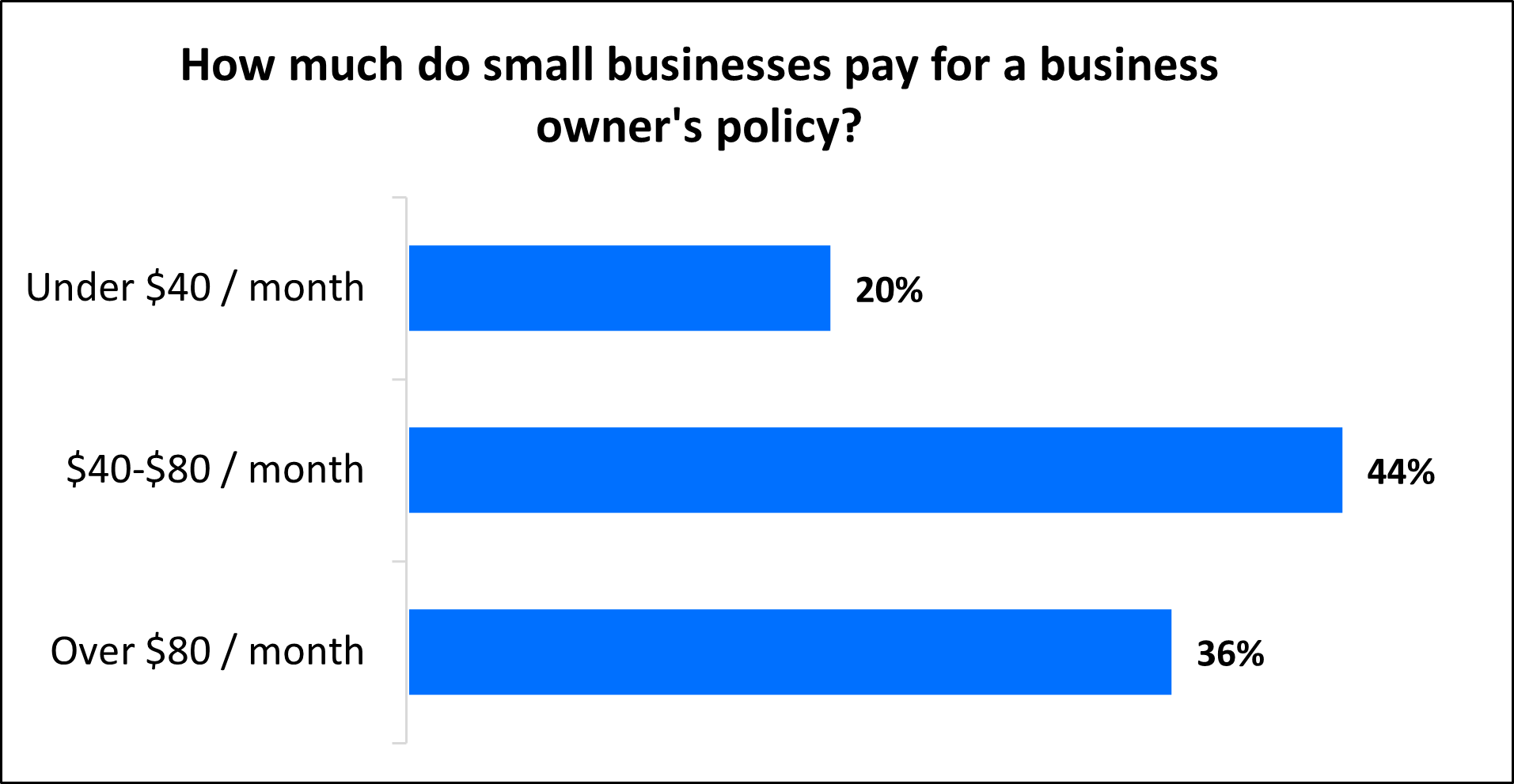

On average, a business owner’s policy costs $57 per month, or about $684 annually. Almost two-thirds (64%) of policyholders can expect to pay under $80 for their business owner's policy.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

How do policy limits impact the cost of a business owner's policy?

Most small businesses choose a $1 million / $2 million business owner’s policy, with an average deductible of $500.

This means the policy has:

- $1 million per occurrence limit: Policy pays up to $1 million on any single claim

- $2 million aggregate limit: Policy pays up to $2 million on all claims

- $500 deductible: The policyholder must pay the deductible of $500 before collecting on a claim

Startups with expensive equipment or a large office space should consider higher policy limits to match the potential cost of damaged property. Higher limits cost more, but you can also receive a higher payout on a claim.

What other factors affect a business owner's policy's costs?

Your coverage limits aren't the only thing that will influence the cost of your BOP.

Your insurance providers will also look at a number of other factors when calculating your insurance rates, such as your business's property value, number of employees, and location.

Commercial property value

If your business experiences property damage, the property coverage of a BOP will help cover the cost of repair or replacement.

If you own or rent valuable commercial property, your BOP premiums will be higher compared to owning or renting a business property that is less valuable.

Industry risks

Your industry is another factor that will impact the cost of your business owner's policy rates. Generally, high-risk industries will have to pay higher premiums compared to low-risk industries.

For example, businesses in industries with a reputation for filing more claims, such as computer repair or other work involving other people’s property, will likely have higher liability insurance costs.

Location

If your business is located in an area with a lot of foot traffic or where many customers pass through, your level of risk increases.

For example, a customer could trip in your store and injure themselves. Or someone could vandalize your business, leaving you with significant property damage. In both cases, a BOP would cover any resulting expenses, such as medical bills or defense costs.

Number of employees

It's simple: The more employees you have, the more opportunities there are for an accident to occur or a client to file a lawsuit.

Even if you are a freelancer, independent contractor or sole proprietor, it's a good idea to carry a BOP to protect yourself from the high costs associated with legal defense and/or medical expenses.

Your claims history

Any claims you’ve made in the past on your BOP insurance will likely result in higher premiums in the future.

How can you save money on a business owner’s policy?

Purchasing a business owner’s policy is already one of the best ways to get affordable commercial insurance.

To save money, your company can also:

Pay your annual premium in full

When you purchase liability coverage, you can pay your premium in monthly or annual installments. The annual premium often costs less than paying month by month.

Choose your office carefully

Commercial property insurance premiums are higher for older buildings, larger properties, and buildings that lack recent updates. Other factors include the distance to the nearest fire department, access to fire hydrants, and the quality of the fire department.

Choose an actual cash value policy

An actual cash value policy insures items for their depreciated value (the value of the used item). A replacement cost policy covers the cost of a brand-new replacement item. Insurers charge more for replacement cost policies.

Manage your risks

Companies with no previous claims can expect to have lower insurance rates. Small business owners can avoid claims with a risk management plan aimed at reducing bodily injury, theft, advertising injury, and other risks.

Your risk management plan should include:

- Installation of sprinkler systems and fire alarms

- Installation of a security system

- Strict protocol for social media posts

- Removal of loose rugs that could trip visitors

- Preparation for natural disasters, such as flooding

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare insurance quotes from top-rated carriers, buy policies based on your business needs, and manage your insurance coverage online.

By completing TechInsurance's easy online application today, you can compare free business owner's policy quotes from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have on a BOP and additional coverages.

Once you find the right types of insurance policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance policies.