How much does commercial property insurance cost?

The average premium for commercial property insurance is $67 per month. However, your coverage limits and property value affect the exact cost of this policy, among other factors.

What is the average cost of commercial property insurance?

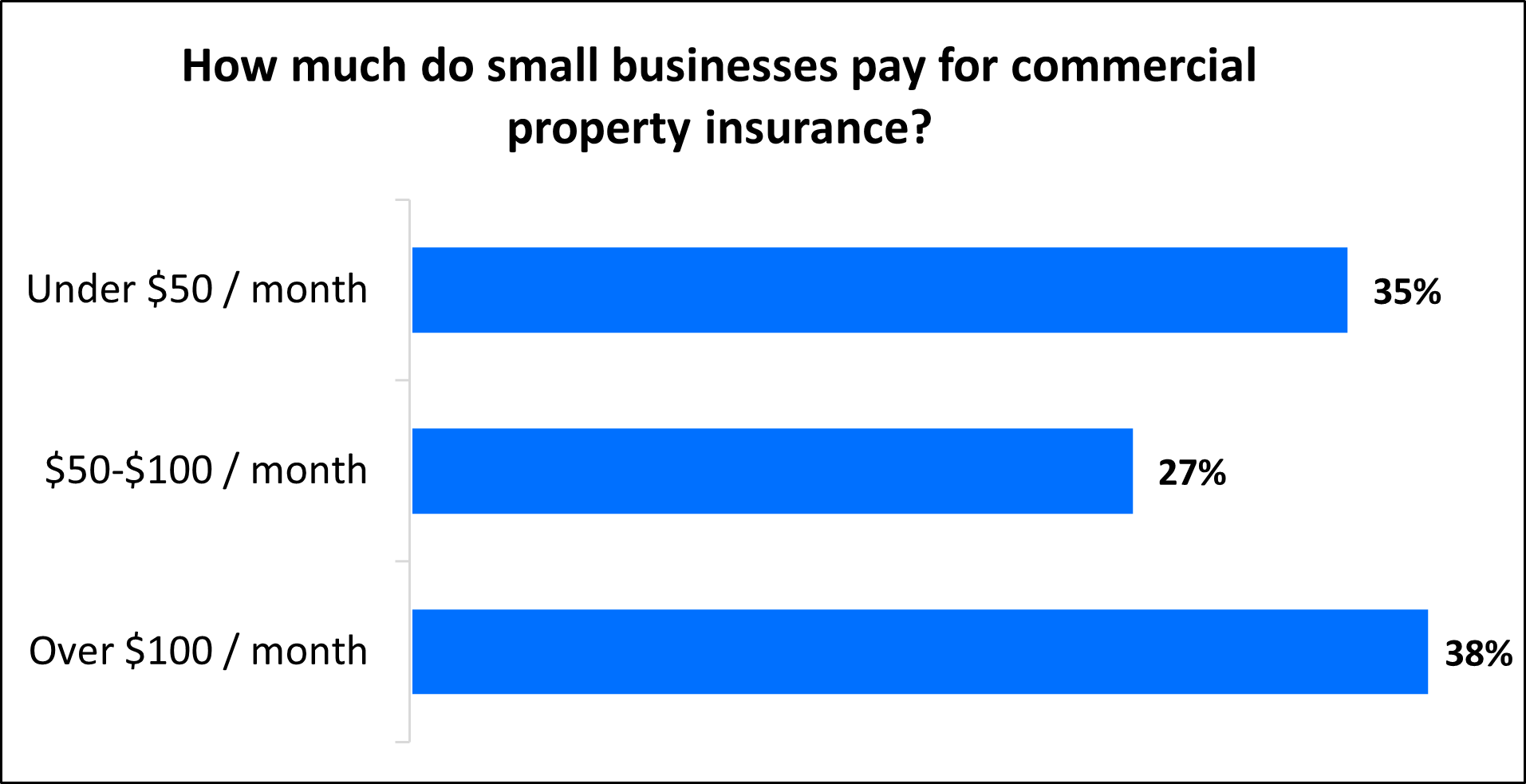

Regardless of insurance policy limits, the average cost of commercial property insurance for a small business is $67 per month (or $800 annually). Almost two-thirds (62%) of policyholders pay less than $100 per month for their commercial property coverage.

These estimates were derived from an analysis of the median cost of thousands of insurance policies purchased by TechInsurance's small business customers. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

How does your industry affect the cost of commercial property coverage?

Commercial property insurance covers your business's physical location and equipment, such as laptops and furniture.

Your industry will impact the cost of your commercial property insurance rates. Generally, high risk industries will have to pay higher premiums compared to low-risk industries.

For example, businesses in industries that are exposed to higher risks, such as a computer repair shop with a lot of foot traffic, will likely have greater insurance costs compared to an IT consultant who works from home.

How do policy limits influence the cost of commercial property insurance?

Businesses that own expensive equipment or an office should consider higher policy limits to match the potential cost of damaged property. Higher limits cost more, but you can also receive a larger payout on a claim.

Because it combines two common policies at a discount, most TechInsurance customers choose a business owner's policy (BOP). A BOP includes both property insurance and general liability insurance, which protects against the risks of working with clients and customers.

Most small businesses choose a $1 million / $2 million business owner’s policy, which means the policy has:

- $1 million per occurrence limit: Policy pays up to $1 million on any single claim

- $2 million aggregate limit: Policy pays up to $2 million on all claims

Policies with lower limits will cost less. You can also save money by paying a higher deductible. However, high deductible options may cost more in the long run.

The average policy deductible for a commercial property policy is $1,000.

What other factors impact the cost of commercial property insurance?

Industry risks and coverage limits are just a couple factors that influence the cost of commercial property insurance.

Let's take a closer look at how other factors may affect your policy:

How does your office location influence costs?

If your business is located in an area with a lot of foot traffic or where many customers pass through, your level of risk increases.

For example, someone could vandalize your business, leaving you with significant property damage. In this case, a commercial property insurance policy would cover any resulting expenses, such as defense costs.

How does your building size and age affect costs?

Older buildings, larger properties, and buildings that lack recent updates will cost more to insure. Other factors include the distance to the nearest fire station, access to fire hydrants, and the quality of the fire department.

How does your commercial property value determine costs?

If your business experiences property damage due to a covered claim, such as vandalism or certain natural disasters, commercial property insurance coverage will help cover the cost of repair or replacement.

If you own or rent valuable commercial property, your policy's premiums will be higher compared to owning or renting a business property that is less valuable.

Or, a company that owns a building will pay more than a company that only needs to cover its computers and office furniture.

How do security and safety measures impact costs?

Having security and safety measures in place can help lower your insurance rates. For example, implementing a multicomponent security plan that includes multiple video cameras and commercial grade locks can help prevent vandalism, especially if you live in a high crime environment.

In addition, you can minimize the chances of a fire or the damage caused by a fire by installing sprinkler systems and a fire extinguisher in the office.

How can you save money on commercial property insurance coverage?

The best way to save money on commercial property insurance is by bundling it with general liability insurance in a business owner’s policy.

Small businesses can also save money by:

Making annual premium payments

When you purchase a commercial property policy, you can pay your premium in monthly or annual installments. The annual premium often costs less than paying month by month.

Opting for an actual cash value policy

An actual cash value policy insures items for their depreciated value (the value of the used item). A replacement cost policy covers the cost of a brand-new replacement item. Insurers charge more for replacement value policies.

Managing your business risks

Companies with no previous claims on their insurance can expect to pay less for business insurance. Business owners can help keep their claims history clean with a risk management plan.

This could include:

- Installation of fire alarms and fire suppression systems

- Installation of security systems, especially in high risk locations

- Employee training on fire extinguishers and similar equipment

- Company protocol that secures valuable equipment

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including startups and independent contractors, with extensive knowledge of the IT sector. We help small business owners compare quotes from top-rated insurance carriers, buy policies based on their business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can get free quotes for commercial property insurance and other types of insurance. Our insurance agents are available to help answer any questions you may have on the different types of coverages.

Once you find the right policies for your small business, you can begin your liability coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about business insurance costs

Insurance premiums vary based on the types of policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance policies.