How much does commercial umbrella insurance cost?

Commercial umbrella insurance raises your policy limit in $1 million increments, providing your business with more compensation per claim. The limits you choose and your level of risk both affect the cost of this policy.

What is the average cost of commercial umbrella insurance?

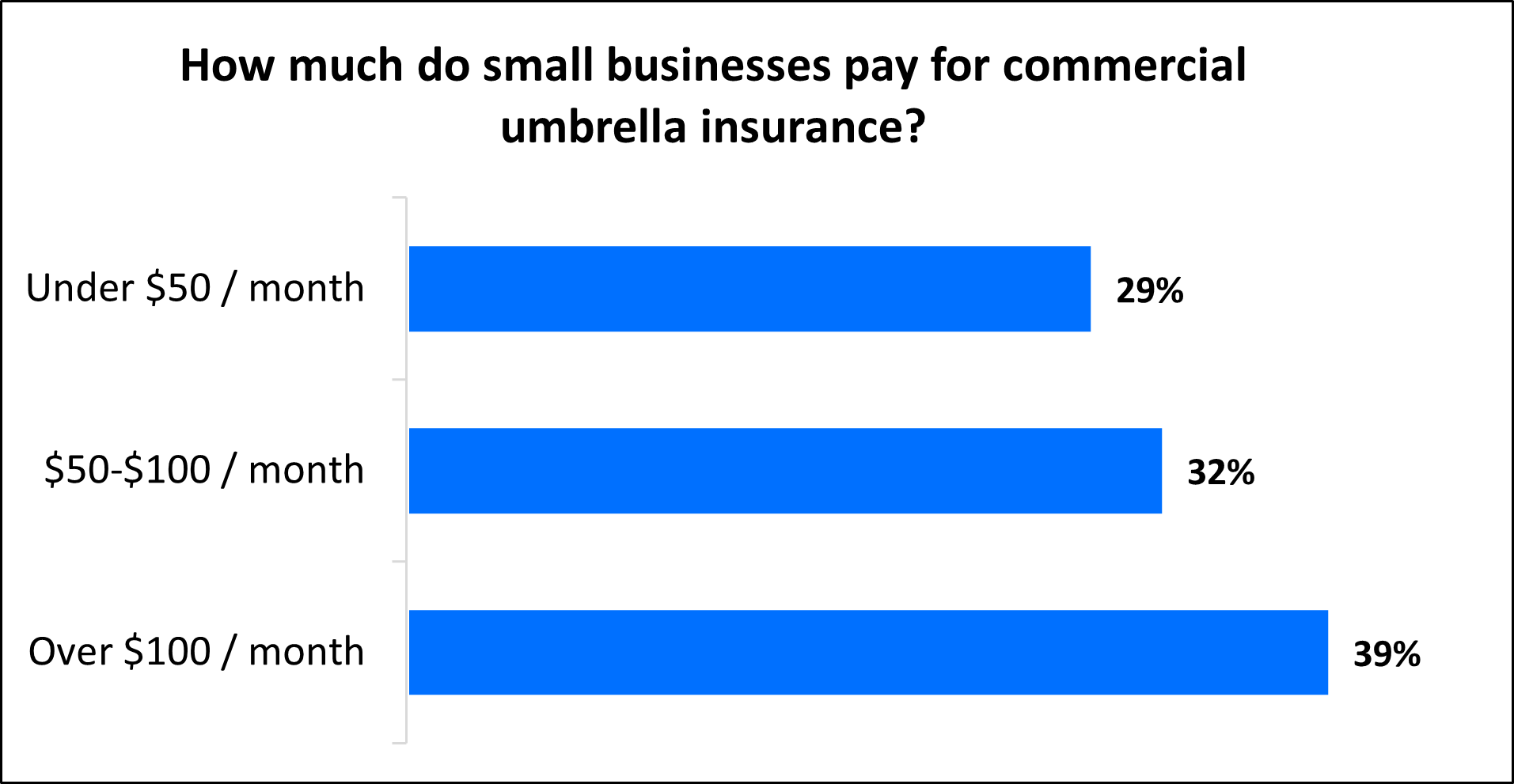

On average, commercial umbrella liability insurance costs $75 per month, or about $900 annually. Almost two-thirds (61%) of policyholders can expect to pay $100 or less for their umbrella liability insurance coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

A commercial umbrella policy boosts the policy limits on your underlying insurance policies, such as:

- General liability insurance

- Employer's liability insurance (part of workers' compensation insurance)

- Hired and non-owned auto insurance (HNOA)

You may need to purchase a certain amount of the underlying coverage before you can purchase umbrella insurance.

How do policy limits affect umbrella liability costs?

Business umbrella insurance (or excess liability insurance) typically increases the limit of the underlying policy in $1 million increments. The higher you raise your policy limit, the more you’ll end up spending on umbrella insurance.

Most TechInsurance customers purchase a $1 million / $2 million umbrella insurance policy. This includes:

- $1 million per-occurrence limit: While the policy is active, the insurer will pay up to $1 million to cover any single claim

- $2 million aggregate limit: During the lifetime of a policy (usually one year), the insurer will pay up to $2 million to cover claims

When buying insurance, evaluate your potential liabilities to see if higher limits are worth the additional cost. A TechInsurance insurance agent can help you secure the right amount of coverage for your risks.

What other factors affect umbrella insurance costs?

Umbrella liability insurance serves as an extra layer of protection by providing additional coverage on common insurance policies, such as an auto insurance policy.

Your coverage limits and industry are just a couple factors that will influence your commercial umbrella insurance rates.

Your insurance provider will also look at:

Claims history

Any liability insurance claims you’ve made in the past will likely result in higher premiums in the future.

Business size

It's simple: The bigger your business is, the more opportunities there are for mishaps to occur.

For example, the more employees you have behind the wheel, the greater the chances are of getting into a car accident. And if you or an employee get in an accident and exceed the coverage limits of your commercial auto policy, then you can count on umbrella insurance for extra coverage. This includes medical expenses and legal fees (if another driver sues).

Location

If your business is located in an area with a lot of foot traffic or where many customers pass through, your level of risk increases.

For example, a customer could trip in your store and injury themselves. Or someone could vandalize your business, leaving you with significant property damage. In both cases, if you exceed your general liability policy's liability limits, then a commercial umbrella insurance policy would cover the remaining expenses, such as outstanding medical bills.

How can you save money on commercial umbrella coverage?

There are things you can do to keep your umbrella insurance policy costs low.

A couple strategies include:

Pay your annual premium upfront

You can usually pay your premium in monthly or annual installments. While it might be tempting to pay monthly premiums, consider paying the full premium instead. Many insurers offer discounts for businesses who pay this way.

Manage your business risks

If your business has no claims history, you’ll likely pay lower insurance rates. An effective way to reduce claims is to create a comprehensive risk management plan.

For example, you might:

- Remove physical hazards in your office to reduce bodily injuries

- Implement a security system

- Develop a detailed training program for employees

- Clearly display procedure checklists

- Create rules for posting to your business’s social media accounts

- Specify and limit who can drive company-owned vehicles to minimize claims on your auto liability policy

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated insurance carriers, buy policies based on your business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for umbrella insurance and other types of insurance from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.