How much does employment practices liability insurance (EPLI) cost?

The average premium for employment practices liability insurance is $222 per month. However, your coverage limits and number of employees affect the exact cost of this policy, among other factors.

What is the average cost of employment practices liability insurance?

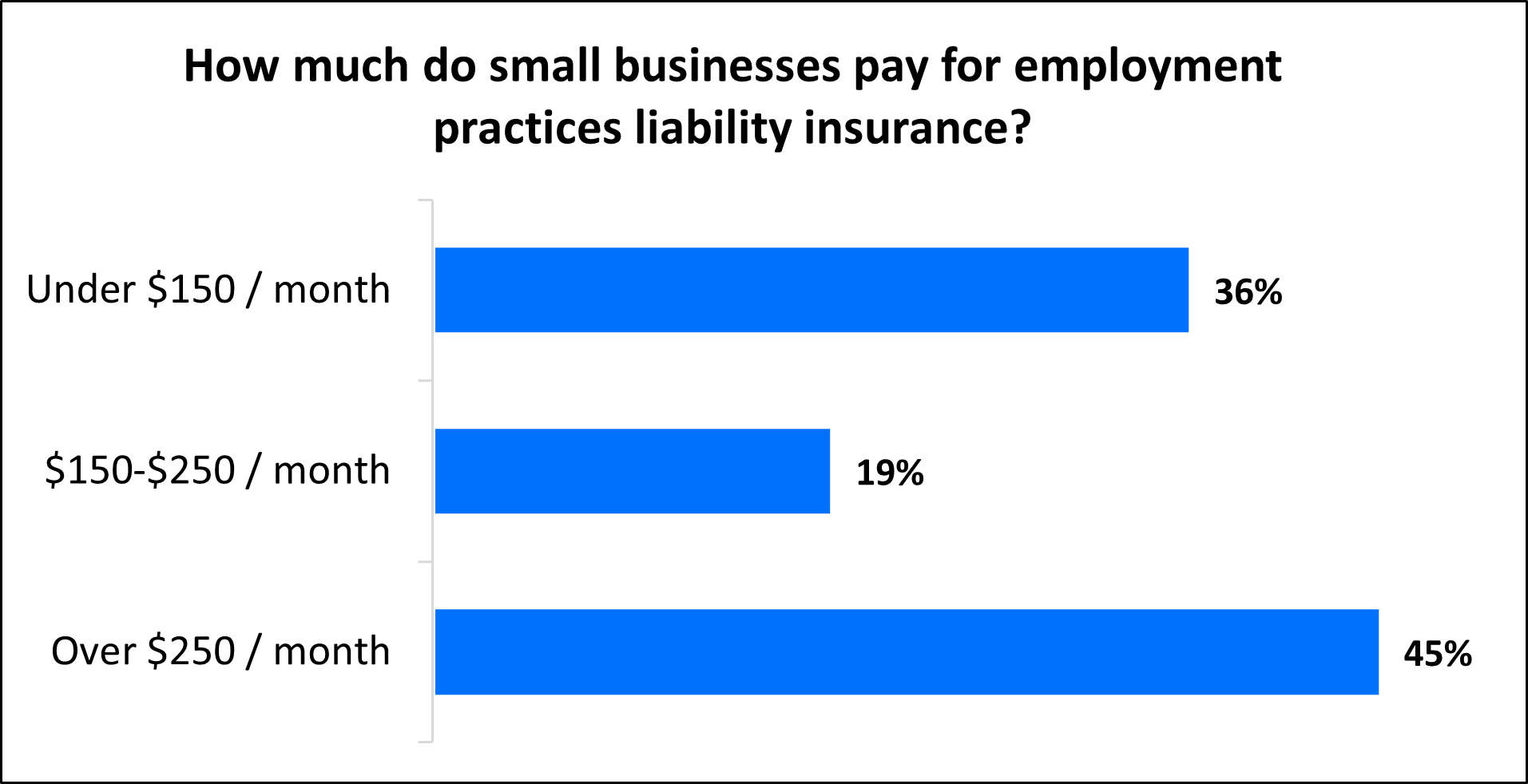

Regardless of insurance policy limits, the average cost of employment practices liability insurance (EPLI) for a small business is $222 per month (or $2,655 annually). Just over a third (36%) of policyholders pay less than $150 per month for their EPLI coverage.

These estimates were derived from an analysis of the median cost of thousands of insurance policies purchased by TechInsurance's small business customers from leading business insurance companies. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Understanding employment practices liability coverage cost factors

Employment practices liability insurance, a type of management liability insurance, covers your small business in case you're faced with an employee lawsuit over a violation of their rights, such as wrongful termination, age discrimination, or sexual harassment. This includes legal defense costs and other related expenses.

Insurance providers will take into account several factors when determining the cost of your EPLI premium, including:

- Coverage limits and deductible

- Industry risk factors

- Number of employees

- Employee turnover rate

- Claims history

- Hiring and termination practices

Policy limits and deductibles determine the cost of employment practices liability insurance

The limits on EPLI policies vary significantly. Each policy has a per-occurrence limit and an aggregate limit:

- Per-occurrence limit: While the policy is active, the insurer will pay up to this amount to cover any single claim.

- Aggregate limit: During the policy period (usually one year), the insurer will pay up to this amount to cover all claims.

Policies with lower limits will cost less. You can also save money by paying a higher deductible. However, high deductible options may cost more in the long run.

The average policy deductible for an EPLI policy is $10,000.

Other factors that impact EPLI insurance costs

Deductibles and coverage limits are just a couple factors that influence the cost of EPLI.

Let's take a closer look at how other factors may affect your policy:

Claims history

Insurance companies look at your claims history to determine how risky you are to insure. Small businesses that have made prior EPLI claims will pay more for insurance than those with a clean history.

Number of employees

It's simple: The more employees you have, the more opportunities there are for one of them to file a lawsuit against your management team.

While an EPLI policy is recommended for most small businesses, most state laws require small business owners to carry workers' compensation if they have employees, and commercial auto insurance if they have business-owned vehicles.

Industry risks

Your industry is another factor that will impact your employment practices liability insurance costs. For example, businesses in industries with a reputation for filing more claims, such as IT consulting, will likely have higher liability insurance costs.

How can you save money on EPLI coverage?

EPLI benefits both private companies and public companies by helping to pay for employment-related lawsuits. Regardless of business type, there are steps you can take to keep your employment practices liability insurance costs low.

A few strategies include:

Paying your annual premium in full

When you purchase a policy, you can pay your premium in monthly or annual installments. The annual premium often costs less than paying month by month.

Bundling policies

Some insurance providers allow small businesses to bundle their employment practices liability insurance policy with directors and officers insurance (D&O). This package usually costs less than purchasing each policy separately.

Managing your business risks

Companies with no previous claims on their insurance can expect to pay less for business insurance. Business owners can avoid claims with a risk management plan.

This could include:

- Instilling harassment prevention workshops to talk about what is and is not acceptable in the workplace

- Forming and maintaining a strong human resources department that regulates employee behavior

- Establishing an employee handbook and educating those in leadership on important employment laws

- Streamlining company protocols for what warrants employee hiring and firing

- Prioritizing responses to employee claims of harassment or violations of other rights

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including startups and independent contractors, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated insurance carriers, buy policies based on your business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can get free quotes for EPL insurance and other types of insurance. Our insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin insurance coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance policies.