How much does directors and officers insurance (D&O) cost?

The average premium for directors and officers insurance is $138 per month. Your coverage limits and the size of your business affect the exact cost of this policy, among other factors.

What is the average cost of directors and officers insurance?

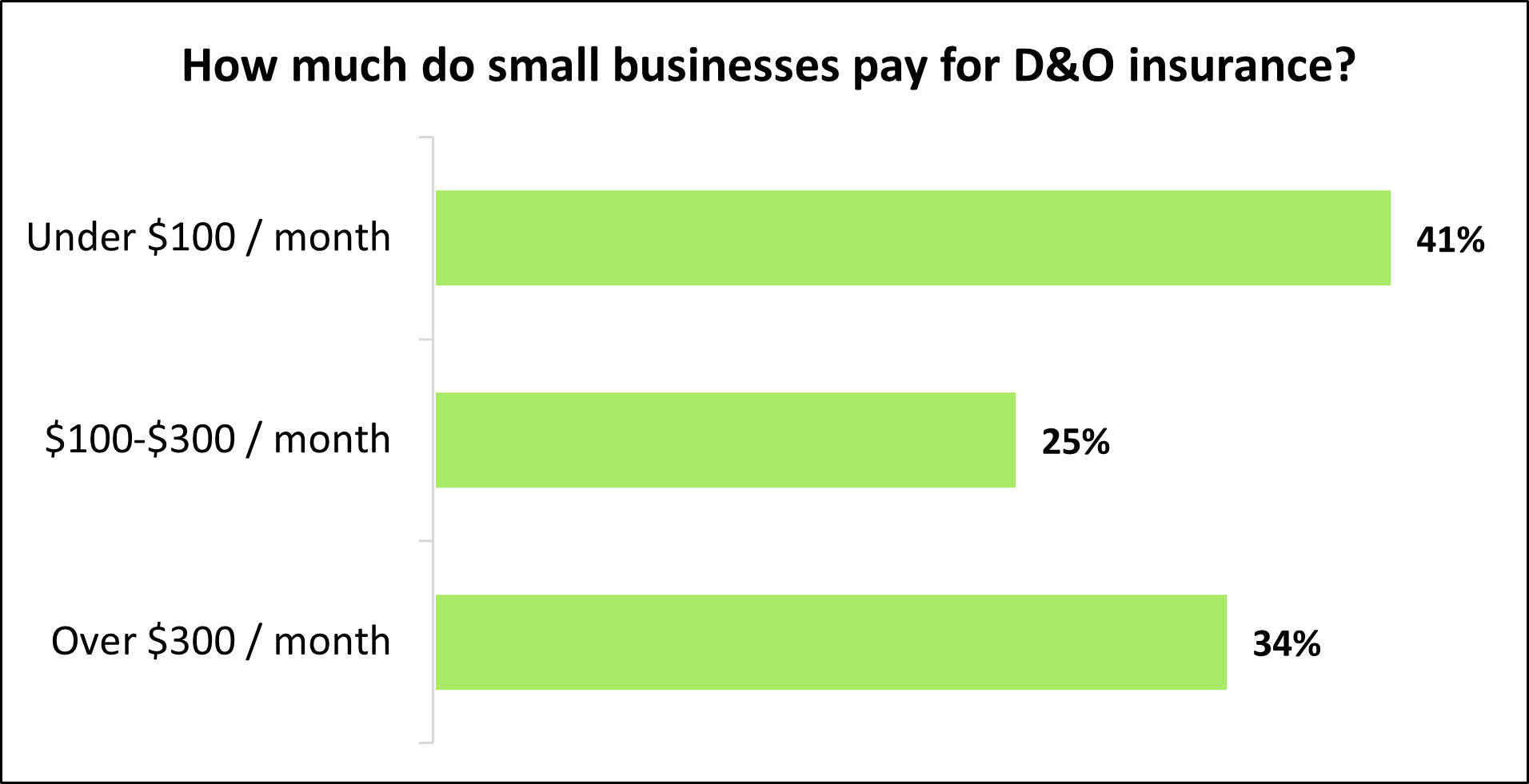

Regardless of insurance policy limits, the average cost of directors and officers insurance for a small business is $138 per month (or $1,653 annually). About four in ten policyholders pay less than $100 per month for their D&O insurance coverage.

These estimates were derived from an analysis of the median cost of thousands of insurance policies purchased by TechInsurance's small business customers from leading business insurance companies. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Policy limits and deductibles determine the cost of directors and officers insurance

Directors and officers insurance, a type of management liability insurance, covers board members and officers if they are sued for a decision they made on behalf of your company, such as a wrongful termination. This includes defense costs and other legal expenses.

The limits on directors and officers policies vary significantly. Each policy has a per-occurrence limit and an aggregate limit:

- Per-occurrence limit: While the policy is active, the insurer will pay up to this amount to cover any single claim.

- Aggregate limit: During the policy period (usually one year), the insurer will pay up to this amount to cover all claims.

Policies with lower limits will cost less. You can also save money by paying a higher deductible. However, high deductible options may cost more in the long run.

The average policy deductible for a D&O policy is $2,500.

Other factors that impact directors and officers insurance costs

Deductibles and coverage limits are just a couple factors that influence the cost of D&O insurance.

Your insurance provider will also look at legal jurisdictions based on location, industry risk factors, number of employees and directors, company revenue, claims history, and potential for initial public offering.

How does your claims history influence costs?

Insurance companies look at your claims history to determine how risky you are to insure. Small businesses that have made prior D&O claims will pay more for insurance than those with a clean history.

How does the number of employees and directors affect costs?

It's simple: The more employees you have, the more opportunities there are for one of them to file a lawsuit against your management team. Likewise, the more directors you have, the more chances there are for a breach of fiduciary duty and a resulting lawsuit.

While a D&O insurance policy is recommended whenever you have a board of directors, most state laws require small business owners to carry workers' compensation insurance if they have employees, and commercial auto insurance if they have business-owned vehicles.

How do industry risks determine costs?

Your industry is another factor that will impact your D&O insurance rates. For example, businesses in industries with a reputation for filing more claims, such as IT consulting, will likely have higher liability insurance costs.

How does your business size impact costs?

The bigger your business is, the more opportunities there are for lawsuits to occur. For example, the more shareholders you have, the greater the chances are for one of them to sue your board of directors.

How can you save money on D&O coverage?

Directors and officers liability insurance benefits both private companies and public companies. Regardless of business type, there are steps you can take to keep your costs low.

A few strategies include:

Bundle policies

Some insurance providers allow small businesses to bundle D&O insurance with employment practices liability insurance (EPLI). This package usually costs less than purchasing each policy separately.

Pay your annual premium up front

When you purchase a policy, you can pay your premium in either monthly or annual installments. The annual premium often costs less than paying month by month.

Manage your business risks

Companies with no previous directors and officers claims on their insurance will have lower premiums. Your business can avoid claims by creating a risk management plan that includes steps like:

- Refining employment practices to improve employee retention

- Educating the board on corporate bylaws to lessen the chances of a wrongful act

- Prioritizing compliance with industry standards to avoid financial losses

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including startups and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated insurance carriers, buy policies based on your business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can get free quotes for directors and officers coverage and other types of insurance. Our insurance agents are available to help answer any questions you may have, such as the differences between Side A, Side B, and Side C in a D&O policy.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.