How much does commercial auto insurance cost?

The average premium cost for commercial auto insurance is about $147 per month. Your exact cost will depend on a few factors, including your policy limits and the type of coverage you choose.

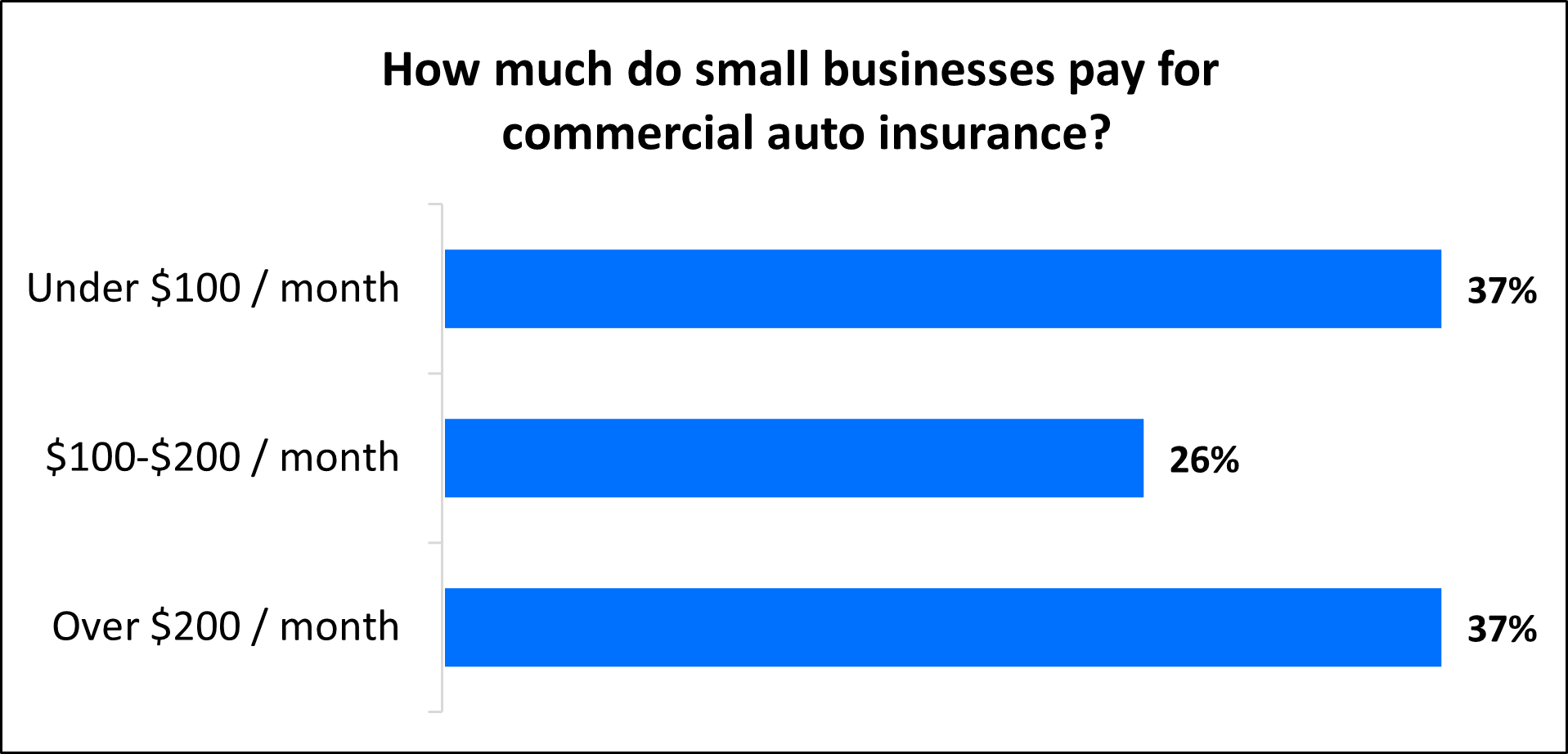

What do small businesses pay for commercial auto insurance?

On average, commercial auto insurance costs $147 per month, or about $1,762 annually.

While TechInsurance's small business customers pay an average of $147 monthly for their commercial auto insurance policy, over a third (37%) pay less than $100. Over a quarter (26%) pay between $100 and $200 per month.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

How can policy limits determine the cost of auto insurance?

The cost you pay for commercial auto insurance depends on your coverage limits. Most small business owners opt for commercial auto insurance coverage with $1 million policy limit.

Commercial auto insurance covers legal and medical bills if your business vehicle is involved in an accident.

Businesses with several company cars or that drive frequently should consider higher liability limits, as they're at higher risk for accidents. Higher limits cost more, but can provide more compensation in the event of an accident.

Other commercial auto insurance cost factors

Your type of vehicle and how much you drive will influence the insurance rates of your commercial auto coverage.

Your insurance provider will also look at:

Type of coverage

The type of auto liability coverage you select will impact the cost of your policy. The less coverage a policy offers, the less you can expect to pay for the plan.

A regular commercial auto policy is typically required in most states for all business-owned vehicles. This typically covers both property damage and liability suits, similar to a personal auto insurance policy. A commercial vehicle insurance policy is usually more expensive than car insurance for your personal vehicle, since the claims tend to cost more.

If you use a leased, rented, or personal car for business purposes, hired and non-owned auto insurance (HNOA) would be the appropriate type of insurance coverage for your small business.

Some policyholders may want to add auto endorsements, as well as collision coverage or comprehensive coverage, to their commercial vehicle policy for extra protection against additional risks, such as theft and vandalism.

Claims history

Insurance companies look at your claims history to determine how risky you are to insure. Companies that have made past commercial auto claims will pay more for insurance than those with a clean history.

Employee driving record and demographics

Your employees' driving records will affect your cost of commercial auto insurance. An employee with a history of collisions and speeding tickets can mean higher premiums.

In addition, the demographics of your employees are another factor that insurance providers will consider. Having younger drivers will less experience may be more costly compared to older, more experienced drivers.

Number of vehicles

It's simple: The more vehicles you own or work on (such as an auto service business or dealership), the more opportunities there are for a car accident to occur.

Even if you are a independent contractor or sole proprietor with one vehicle, it's still a good idea to carry commercial auto coverage to protect yourself from the high costs associated with accidents, such as medical expenses from bodily injuries. Without it, you will be responsible to pay for medical payments and other costs out-of-pocket.

How can you save money on commercial auto insurance?

It’s easy to save money on your business auto insurance without compromising on coverage.

Some strategies to keep costs down include:

- Paying the annual premium. When you purchase a commercial auto policy, you can choose to pay your premium in either monthly or annual installments. The annual premium often costs less than paying month by month.

- Choosing a higher deductible. Choosing a higher deductible is an effortless way to save on your premium, but make sure to choose a deductible you can still afford. If you can’t pay it, you can’t collect on a claim.

How can you avoid making claims on your commercial auto policy?

The fewer commercial auto insurance claims your business makes, the less your insurance premiums cost. You should aim to minimize risks to avoid claims and keep your premium low.

A good risk management strategy to reduce commercial auto claims includes:

- Frequent car inspections and maintenance

- Keeping records of employees' driving history

- Avoiding texts or calls to employees on the road

- Mandatory drug and alcohol tests after an accident

Even though you can’t eliminate risks entirely, risk management helps you sidestep common pitfalls that lead to liability claims and higher commercial auto insurance costs.

It’s not as difficult as you might think to find affordable small business insurance. From comparison shopping to bundling policies, learn how you can save money and still protect your business.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including limited liability companies (LLCs) and freelancers, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for errors and omissions insurance and other coverage options from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right commercial policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.