How much does business insurance cost for IT and software companies?

Technology business insurance costs are based on policy limits, deductibles, types of policies purchased, and several other factors. Save money on business insurance by comparing quotes from different carriers with TechInsurance.

How much does technology business insurance cost?

Technology business insurance costs are determined by a number of things, such as policy limits, deductibles, and your annual revenue.

Another key factor is your level of risk. Generally speaking, the more likely your technology business is to encounter a risk, the higher your annual premium.

Overall, tech business insurance is more expensive if your business:

- Owns or rents a large space

- Experiences high foot traffic

- Employs many workers

- Has a history of insurance claims, or operates in a profession with a history of claims

There's no one business insurance policy that covers every single risk. Small businesses can choose the liability policies that make sense for their business's unique risks.

Let's take a closer look at costs for different types of business insurance.

Key insurance policies and their expected costs for technology businesses

Here are the top insurance policies bought by technology businesses and their average monthly costs:

- Technology errors and omissions insurance (tech E&O): $67 per month

- General liability insurance: $30 per month

- Cyber insurance: $148 per month

- Fidelity bonds: $107 per month

- Workers' compensation: $34 per month

- Commercial auto insurance: $198 per month

Our figures are sourced from the median cost of policies for technology companies that apply for quotes with TechInsurance. The median provides a better estimate of your expected insurance costs because it excludes outlier high and low premiums.

Tech errors and omissions insurance coverage

Technology businesses spend an average of $67 per month, or $807 yearly, for technology errors and omissions insurance. This coverage combines errors and omissions insurance and cyber insurance into one policy, often costing less than buying each of these coverages separately.

Also known as professional liability insurance, E&O insurance protects small businesses against claims of professional negligence. For example, if your technology company fails to meet a deadline and that causes a client financial loss, you could find yourself facing a lawsuit.

Tech E&O includes third-party cyber insurance with this coverage, which adds extra protection in case your tech business unintentionally causes a data breach or cyberattack at a customer's company.

Below is the average E&O insurance policy for technology companies that purchase from TechInsurance:

Insurance premium: $67 per month

Policy limits: $1 million per occurrence; $1 million aggregate

Deductible: $2,500

The cost of errors and omissions insurance is based on many factors, including the policy limits you choose, the types of professional services you provide, and your claims history.

Your risk level drives your tech E&O insurance cost

Among technology and software businesses that purchase technology errors and omissions insurance coverage with TechInsurance, over half (53%) can expect to pay between $50 and $100 per month.

The cost of E&O insurance is directly related to your risk of being sued over your work performance, such as a data error that results in financial loss for your client.

When your errors and omissions coverage is bundled with cyber insurance, then the amount of personal data you interact with at your company (e.g., credit card numbers, phone numbers, etc.) will also impact your cost.

Coverage limits impact your tech E&O insurance costs

An insurance policy will provide coverage up to a specific dollar amount, or limit. Most policies have two limits:

- The aggregate limit is the maximum your insurance company will pay on all claims during the policy period (usually one year).

- The per-occurrence limit is the most your insurance company will pay for a single claim.

Over half (56%) of IT businesses select E&O insurance policies with a $1 million per-occurrence limit and a $1 million aggregate limit.

Similar to other small business insurance costs, the amount you pay for E&O insurance increases with your coverage limits.

General liability insurance for technology businesses

Technology startups spend an average of $30 per month, or $363 per year, for general liability insurance. Though usually not required by law, a general liability policy may be needed in order to sign a lease or work with some clients.

General liability coverage protects your small business from common third-party risks, such as customer property damage or bodily injury. It also pays for lawsuits related to copyright infringement and defamation, including slander and libel.

For example, if a competitor claims that an employee at your technology company made a disparaging statement about them on social media and decides to sue, a general liability policy would pay for any legal costs.

Below is the average general liability insurance policy for technology businesses who buy from TechInsurance:

Premium: $30 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

If your business is small and low risk, TechInsurance's licensed agents usually recommend a business owner’s policy (BOP). A BOP bundles general liability insurance with commercial property insurance at a lower cost than buying these policies separately.

For technology companies, the average cost of a business owner's policy is $46 per month or $550 per year. To protect against financial losses due to a forced closure, such as from a fire or flooding, you can also add business interruption insurance to a BOP.

The cost of general liability insurance is based on several factors, including the types of services offered, policy limits, size and location of your business, and any subcontractors or additional insured endorsements you may have.

Your industry determines your general liability insurance costs

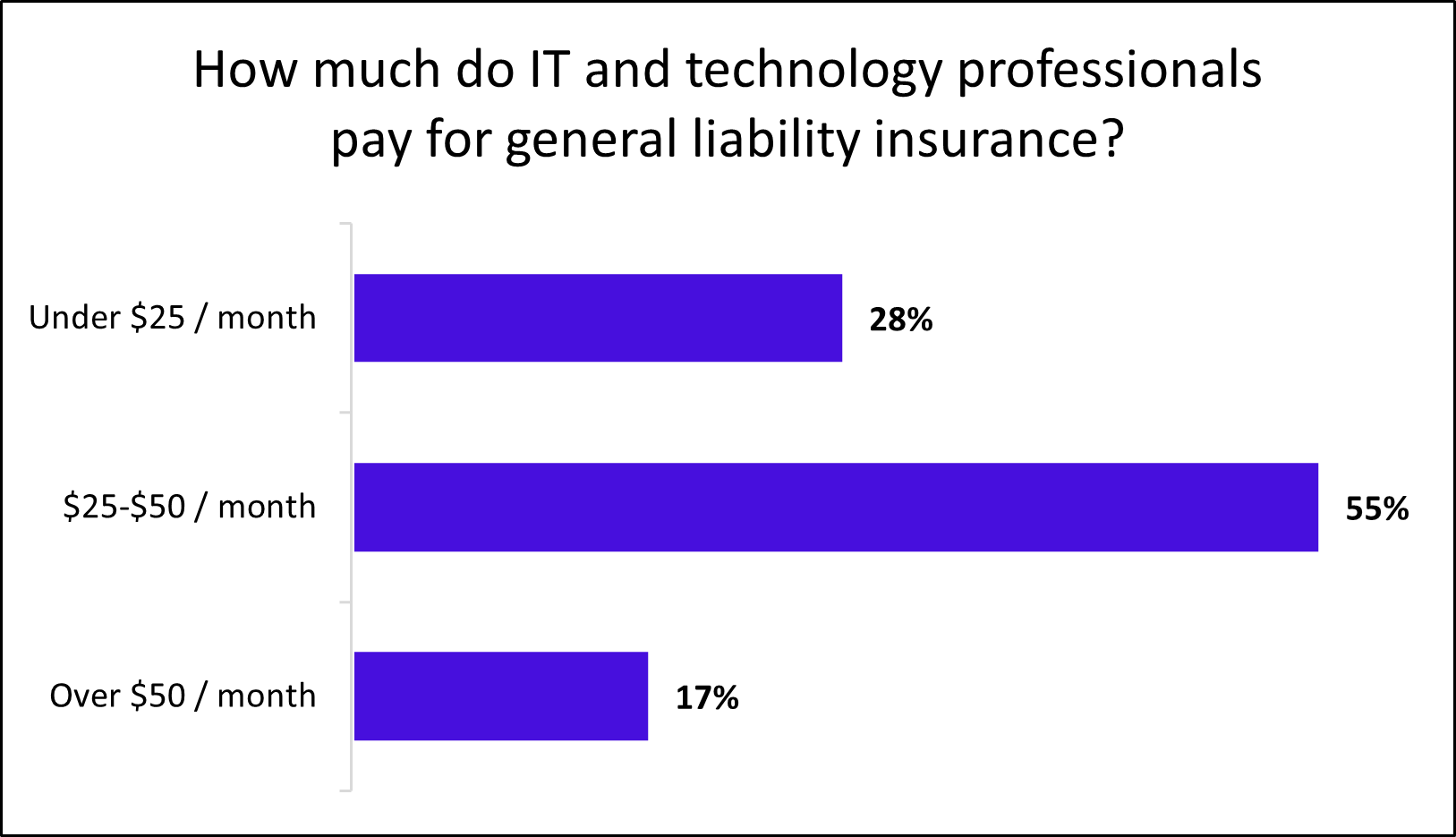

Looking at technology professionals who purchase commercial general liability coverage with TechInsurance, over half (55%) can expect to pay between $25 to $50 per month. In addition, over a quarter (28%) can expect to pay less than $25 per month.

The risks associated with your specific industry impact your general liability insurance premium. Factors like having a storefront, frequent interaction with customer property, and heavy foot traffic at your business property put you at high risk, often resulting in more expensive insurance rates.

For example, a computer repair shop that sees a lot of foot traffic would likely have a higher premium than a software programmer who works from home.

Cyber insurance for technology businesses

Technology companies spend an average of $148 per month, or $1,775 annually, for cyber insurance. Also known as cyber liability insurance or cybersecurity insurance, this policy helps pay for the cost of complying with your state's data breach laws.

A cyber insurance policy can cover expenses related to a data breach or cyberattack, including legal fees and customer notification costs. It is especially crucial for companies that store personal customer information, such as credit card numbers or Social Security numbers.

The cost of cyber insurance primarily depends on the amount of sensitive information handled by your technology business.

The amount of personal data you handle affects your cyber insurance costs

Among technology businesses that purchase cyber insurance with TechInsurance, two thirds (66%) of policyholders can expect to pay less than $200 per month. And almost one third (30%) of customers can expect to pay less than $100 per month.

Your cyber insurance cost is directly influenced by the amount of sensitive information you handle at your technology business. The more personal data you interact with, the higher your cost will likely be.

Fidelity bonds for technology businesses

The average cost of a fidelity bond is $107 per month, or $1,283 annually, for technology businesses. Some clients, especially those in the financial services industry, may mandate a bond in order to sign a contract with them.

Fidelity bonds, a type of surety bond, protect your clients by reimbursing them in the event your employee commits theft, fraud, or forgery. This include illegal electronic funds transfer and unapproved credit card purchases.

The cost of a fidelity bond is a certain percentage of the total bond amount. Unlike most insurance policies, this amount must be paid back to the company that issued the bond.

Workers' compensation insurance for technology businesses

Technology businesses spend an average of $34 per month, or $412 annually, for workers' compensation insurance. To comply with state requirements and avoid penalties, tech businesses with one or more employees typically are required to purchase this policy.

Workers' comp coverage pays for medical expenses and disability benefits when you or an employee suffers a work-related injury or illness. For example, if an employee at your company develops carpal tunnel, a workers' comp policy would pay for their treatments and lost income while they recover.

Workers' compensation coverage often includes employer's liability insurance, which pays for legal defense costs related to a workplace injury lawsuit.

Even though workers' comp may not be required for sole proprietors or independent contractors, it is highly recommended since most health insurance plans can deny claims for injuries that occur at your jobsite, leaving you to pay out of pocket.

The cost of workers' comp is based on numerous factors, including the number of employees you have and their occupational risks.

Commercial auto insurance for technology businesses

Technology companies spend an average of $198 per month, or $2,375 yearly, for commercial auto insurance. Almost every state requires this type of insurance if your technology business owns any company vehicles.

If your business vehicle(s) are involved in an accident, a commercial auto policy would help cover property damage costs and any medical expenses. This coverage also helps pay for costs related to vehicle vandalism, weather damage, and theft.

To protect personal, rented, and leased vehicles used for business purposes, you'd need hired and non-owned auto insurance (HNOA) instead.

Commercial auto insurance costs depend on many factors, including your employees' driving records, policy limits, the number of vehicles you own and their value, and your coverage options.

How do I get affordable IT business insurance with TechInsurance?

TechInsurance makes it easy for data scientists, IT consultants, and other technology businesses to obtain affordable business insurance in three easy steps:

- Fill out a free online insurance application with details about your business.

- Compare custom business insurance quotes from top-rated U.S. companies in real-time.

- Choose the best policies for your business and pay the premiums to begin coverage.

TechInsurance's licensed insurance agents are available to help answers questions about your liabilities and risk management, state insurance requirements, and the best types of coverage for your business needs.

Once you've bought the business insurance coverage you need, you can download a certificate of insurance for proof of insurance. Small business owners usually get insured within 24 hours of applying for quotes.