How much does consulting business insurance cost?

Consultant insurance costs depend on the types of policies and amount of coverage you choose. Insurers will also look at your consulting services, business revenue, and claims history. Save money on small business insurance by comparing quotes from different providers with TechInsurance.

Key insurance policies and their expected costs for consulting businesses

Here are the top insurance policies bought by consulting businesses and their average monthly costs:

- General liability insurance: $29 per month

- Professional liability insurance: $55 per month

- Workers' compensation insurance: $40 per month

- Cyber insurance: $92 per month

- Commercial auto insurance: $146 per month

Our figures are sourced from the median cost of policies for consulting companies that apply for quotes with TechInsurance. The median provides a better estimate of your expected insurance costs because it excludes outlier high and low premiums.

General liability insurance costs for consulting businesses

Consulting businesses spend an average of $29 per month, or $350 per year, for general liability insurance. Management consultants, marketing consultants, IT consultants, and other types of consultants may need this coverage in order to get licensed in their state.

General liability insurance covers legal costs when a third-party (someone outside your company) files a lawsuit over property damage or a bodily injury. It also pays for advertising injuries, such as libel, slander, and copyright infringement.

For example, if a client trips in your consulting office and breaks their wrist, then a general liability insurance policy would help cover their medical bills and any legal fees.

This is the average general liability policy for consulting businesses that buy from TechInsurance:

Premium: $29 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

If your business is small and low risk, TechInsurance's licensed agents usually recommend a business owner’s policy (BOP). A BOP bundles general liability insurance with commercial property insurance at a lower cost than buying these policies separately.

For consulting companies, the average cost of a business owner's policy is $42 per month or $500 per year. To protect against financial losses due to a forced closure, such as from a fire or flooding, you can also add business interruption insurance to a BOP.

The cost of general liability insurance is based on several factors, including the types of professional services offered, policy limits, size and location of your business, and any subcontractors or additional insured endorsements you may have.

Coverage limits and deductibles determine general liability costs

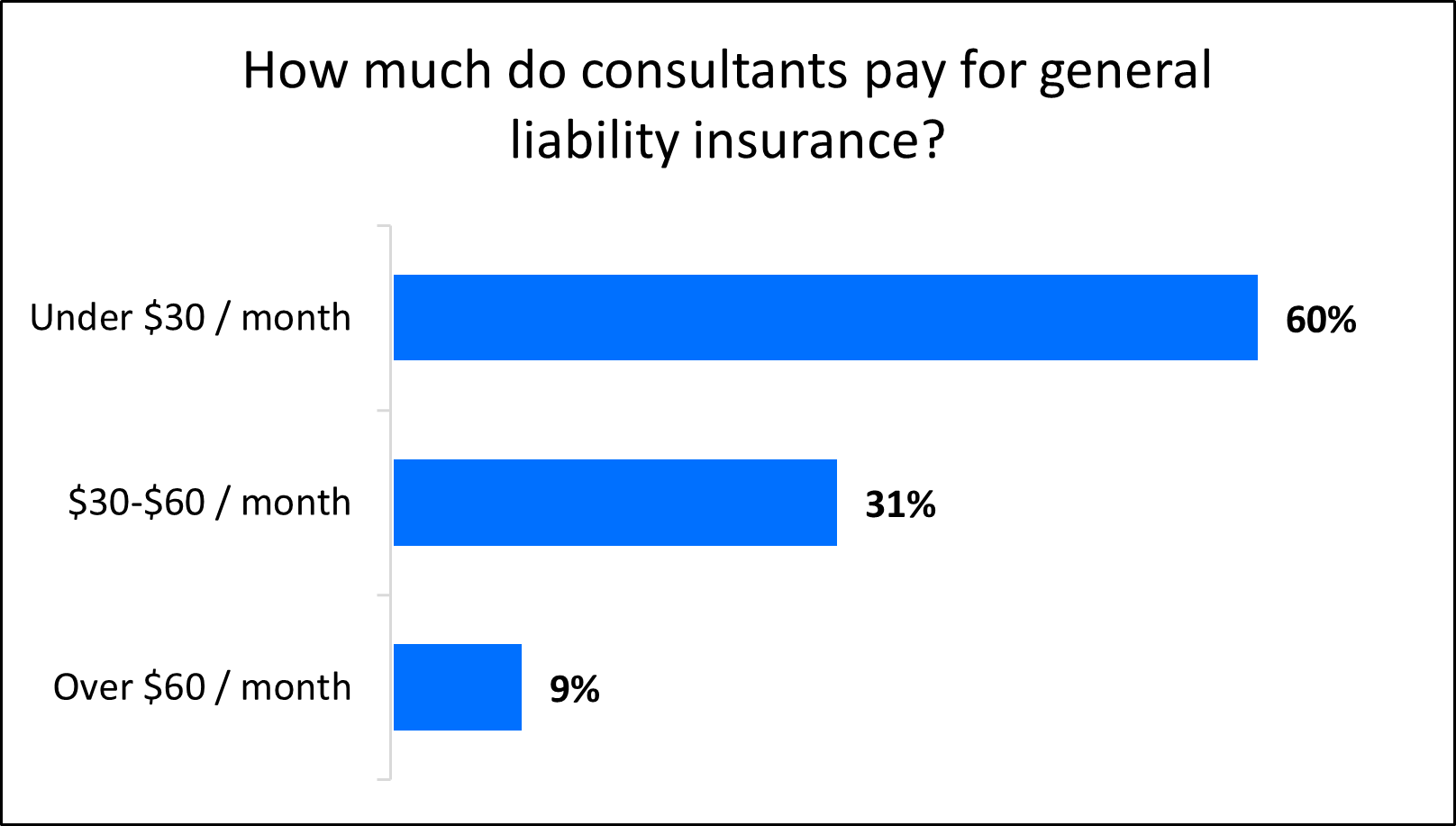

Among consulting businesses that buy with TechInsurance, 60% pay less than $30 per month for general liability insurance. Another 31% pay between $30 and $60 per month.

Most consulting companies (89%) choose a general liability insurance policy with a $1 million per-occurrence limit and a $2 million aggregate limit. The average deductible is $500.

The per-occurrence limit is the most your insurance company will pay for a single incident. The aggregate limit is the most it’ll pay during the policy period, which is typically one year. Your insurance provider will pay claims up to your policy limits, which is why higher limits cost more.

It’s possible to save money on your premium by opting for a higher deductible, but make sure you budget for that cost. Your liability coverage will only kick in once the deductible is paid.

Professional liability insurance costs for consulting businesses

Consulting businesses pay an average premium of $55 per month, or $662 annually, for professional liability insurance. This policy is also referred to as errors and omissions insurance, or E&O insurance.

This policy helps pay for legal costs related to accusations of professional negligence. For example, a management consultant could face a lawsuit for providing advice to a client that caused a financial loss.

Below is the average professional liability policy for consulting companies that buy from TechInsurance:

Insurance premium: $55 per month

Policy limits: $1 million per occurrence; $1 million aggregate

Deductible: $1,000

IT consultants may opt for technology professional liability insurance, which bundles professional liability insurance with cyber insurance. This policy not only covers accusations of negligence, but also data breaches that affect a tech business's or client's operations.

The cost of professional liability insurance depends on factors such as the policy limits you choose, your line of work, and your claims history.

Professional liability insurance costs are determined by your amount of risk

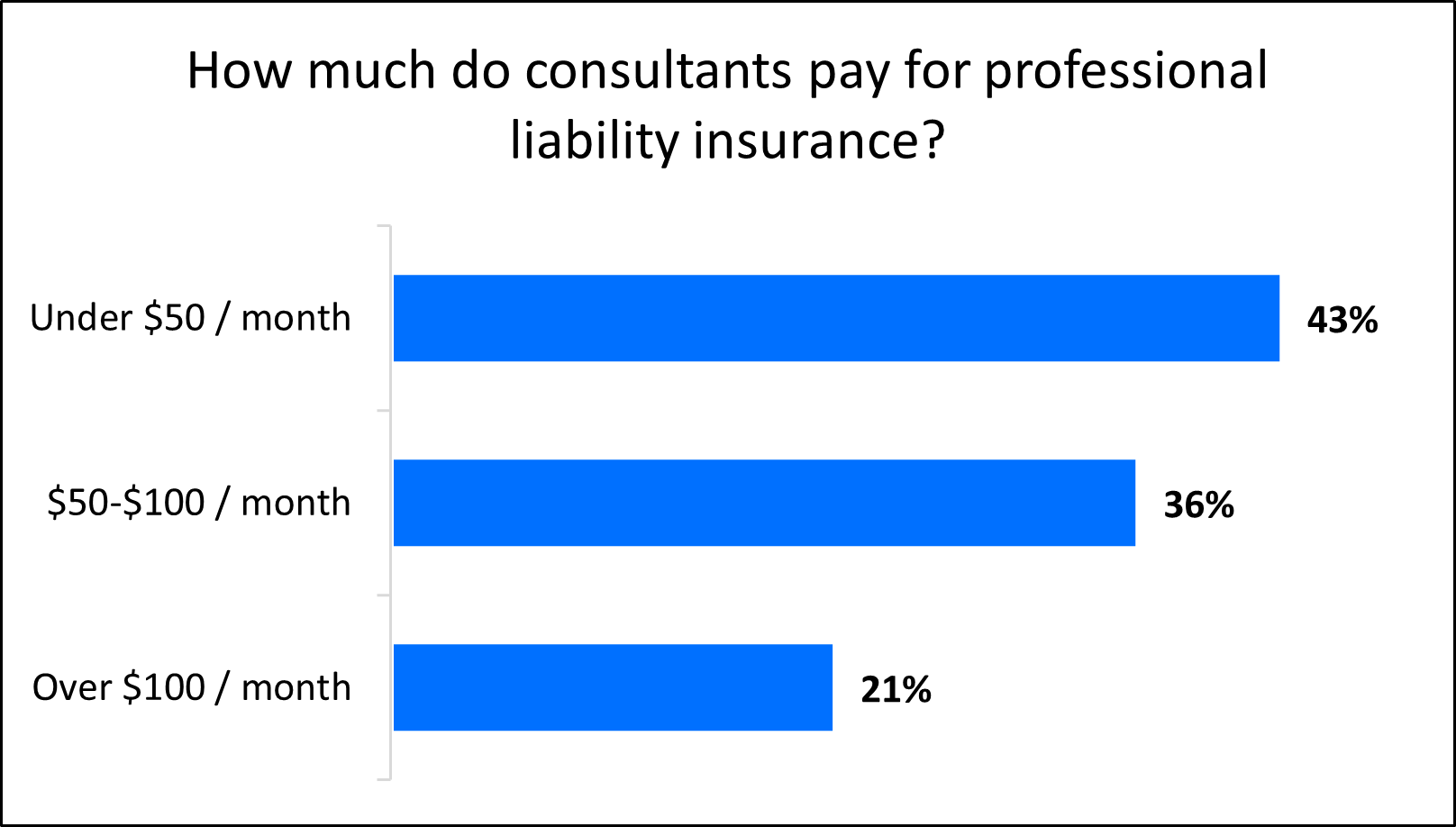

Among consulting businesses that purchase professional liability insurance coverage with TechInsurance, almost half (43%) can expect to pay under $50 per month. Another 36% spend, on average, between $50 and $100 on their professional liability policy.

The cost of professional liability insurance is directly related to your risk of being sued over your work performance, such as harmful advice that results in financial loss for your client.

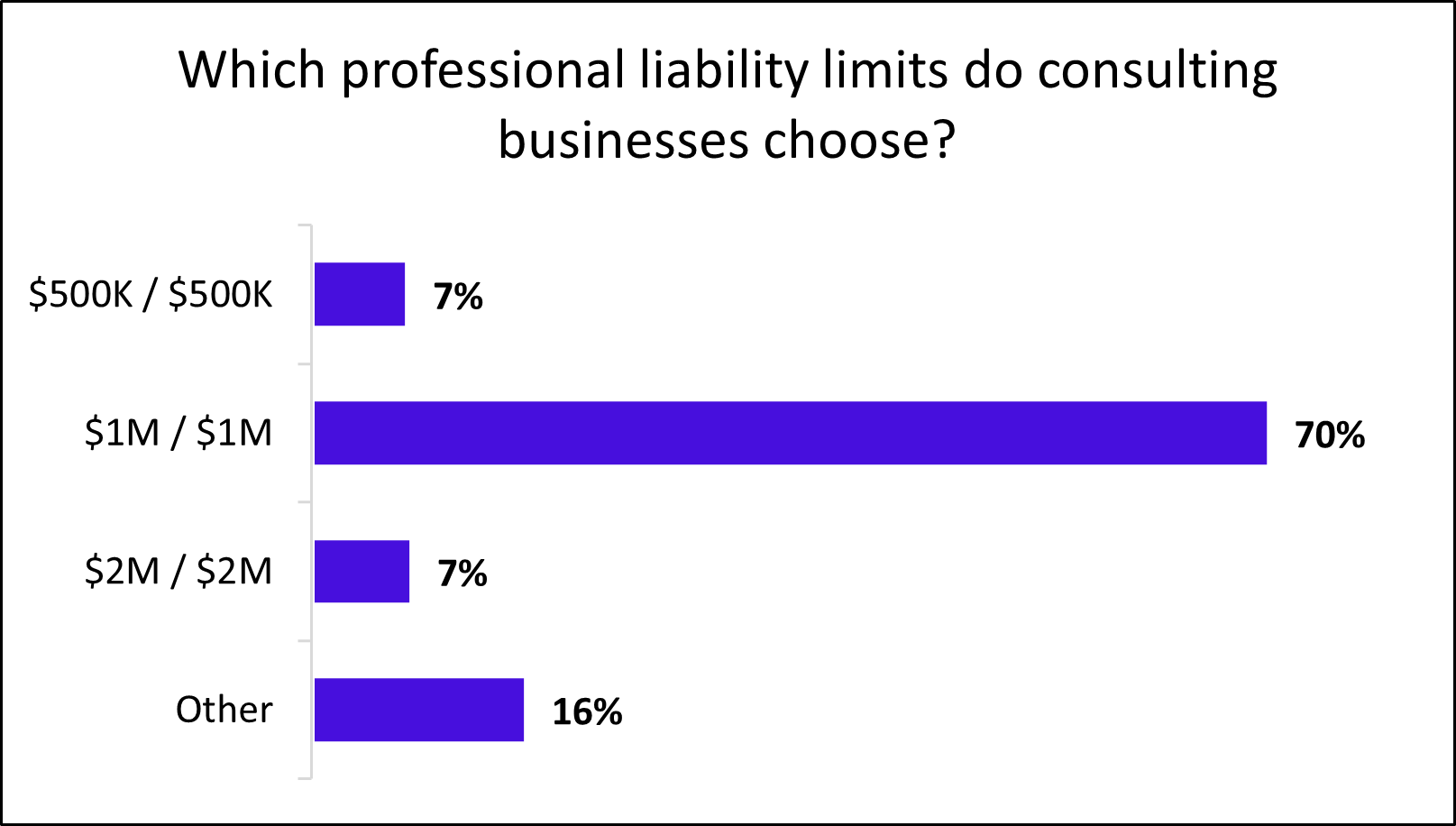

Professional liability insurance limits and deductibles

Most consultants (70%) choose a professional liability insurance policy with a $1 million per-occurrence limit and a $1 million aggregate limit. The average deductible is $1,000.

You may want to choose higher limits if:

- Clients depend on your expert advice to increase profits

- You are responsible for clients’ cybersecurity

- You recommend software or work performance plans to your clients

- A delay or mistake on your part will impact clients’ finances in any way

Workers’ compensation insurance costs for consulting businesses

On average, consulting business owners pay $40 per month for workers' compensation insurance, or $477 annually.

State laws determine when you need workers' comp. In most states, you need it as soon as you hire your first employee. Only Texas and South Dakota do not have requirements for workers' comp, but it's still recommended.

Workers' compensation pays for medical expenses and provides disability benefits if you or an employee suffers an injury on the job, or develops an occupational disease.

For example, if an employee at your consulting business develops carpal tunnel, this policy would pay for their medical appointments and prescriptions. It also supplies part of the income they miss out on while they are recovering and unable to work.

Most workers' compensation policies include employer's liability insurance. This type of insurance helps pays for legal defense expenses, including court costs, related to workplace injuries.

Though sole proprietors and independent contractors aren't often required to carry workers' comp, it's still a good idea to buy this coverage. If you're injured on the job, your health insurance plan will likely deny the claim, leaving you with hefty out-of-pocket medical bills.

The cost of workers' comp depends on occupational risks

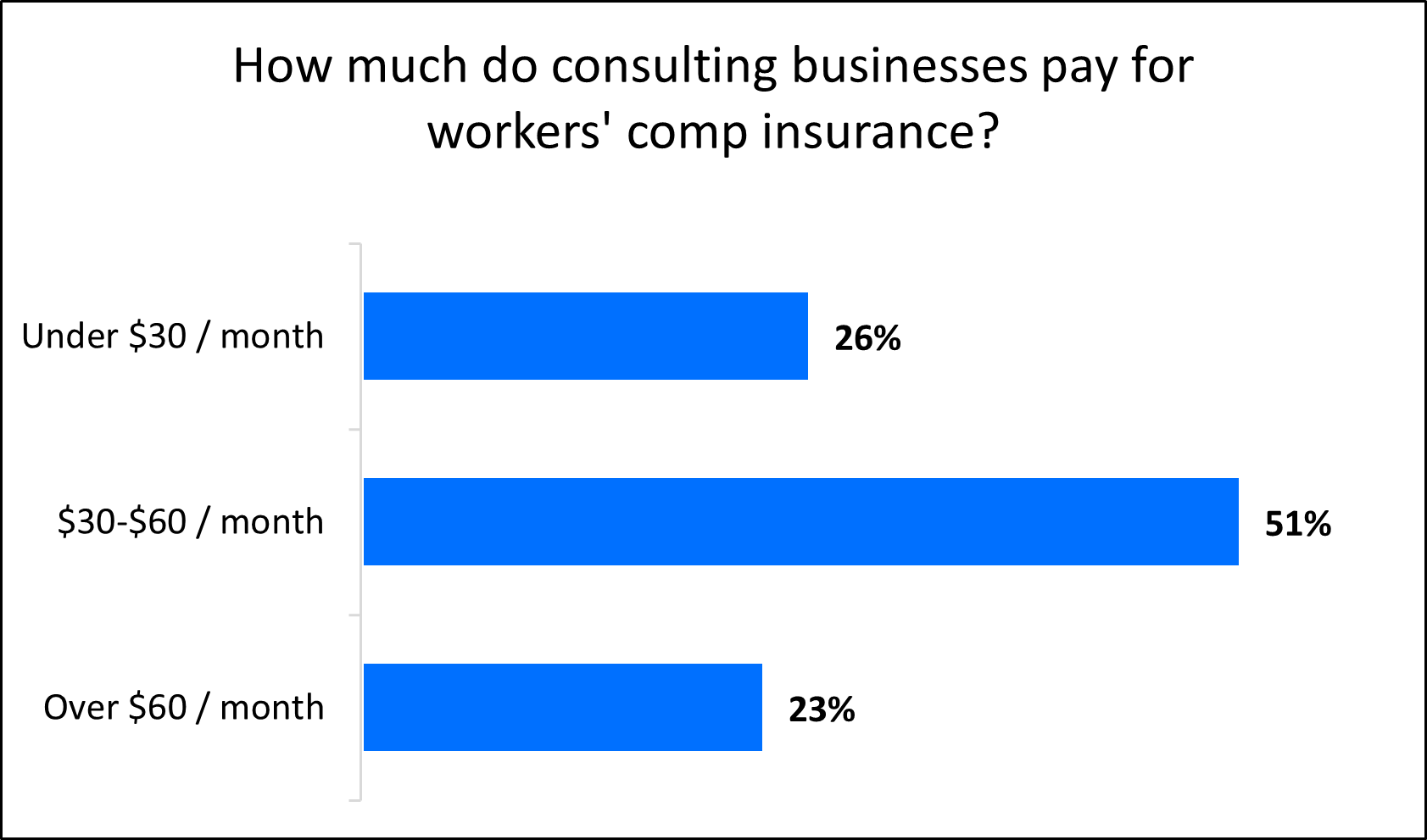

The chance of an on-the-job injury is the biggest factor in determining workers' compensation insurance premiums.

Workers' comp can be very affordable for most consulting firms. As you can see, 26% of TechInsurance's consulting customers pay less than $30 per month for workers' compensation insurance. And 77% pay $60 or less per month for insurance coverage.

Insurance companies will take into account the number of employees you have, their occupational risks, and your claims history when calculating the cost of workers' comp.

Cyber insurance costs for consulting businesses

Consulting companies spend an average of $92 per month, or $1,105 annually, for cyber insurance. Also known as cyber liability insurance or cybersecurity insurance, this policy helps pay for the cost of complying with your state's data breach laws.

A cyber insurance policy can cover expenses related to a data breach or cyberattack, including legal fees and customer notification costs. It is especially crucial for companies that store personal customer information, such as credit card numbers or Social Security numbers.

The cost of cyber insurance primarily depends on the amount of sensitive information handled by your consulting business.

Commercial auto insurance for consulting businesses

Consulting businesses spend an average of $146 per month, or $1,757 per year, for commercial auto insurance.

Most states require this coverage for vehicles owned by a business. If you get into an accident, it can help pay for medical expenses, property repairs, and legal fees. It also covers vehicle theft and vandalism, in case your car or other company vehicle is stolen or damaged.

Keep in mind that sole proprietors and independent contractors who drive their own vehicle for work will need extra coverage as well. Your personal auto policy won't cover work-related accidents, so you'll want to consider buying hired and non-owned auto insurance (HNOA).

HNOA provides liability coverage for personal, leased, and rented vehicles driven for work purposes.

Insurance companies consider many factors when determining the cost of a commercial auto policy. That includes your employees' driving records, policy limits and deductibles, the number of vehicles you own and their value, and the coverage options you choose.

How do I get affordable consulting business insurance with TechInsurance?

Management consultants, education consultants, marketing consultants, and other consulting professionals can find affordable business insurance in three easy steps with TechInsurance:

- Fill out a free online insurance application with details about your business.

- Compare custom business insurance quotes from top-rated U.S. companies in real-time.

- Choose the best policies for your business and pay the premiums to begin coverage.

TechInsurance's licensed insurance agents are available to help answer questions about state insurance requirements and the best types of business insurance for your needs.

Once you've bought a policy, you can download a certificate of insurance for peace of mind and proof of insurance. Small business owners usually get insured within 24 hours of applying for quotes.