How much does independent contractor insurance cost?

The most common type of commercial insurance, general liability insurance, costs about $30 per month. As an entrepreneur, you are putting countless hours and energy into your business, and this coverage can protect what you are building.

What are the costs of common business insurance policies for independent contractors?

Independent contractors may not need the same insurance coverage as a larger company. For example, a web designer who works from home likely won’t need coverage for their business property or any employees.

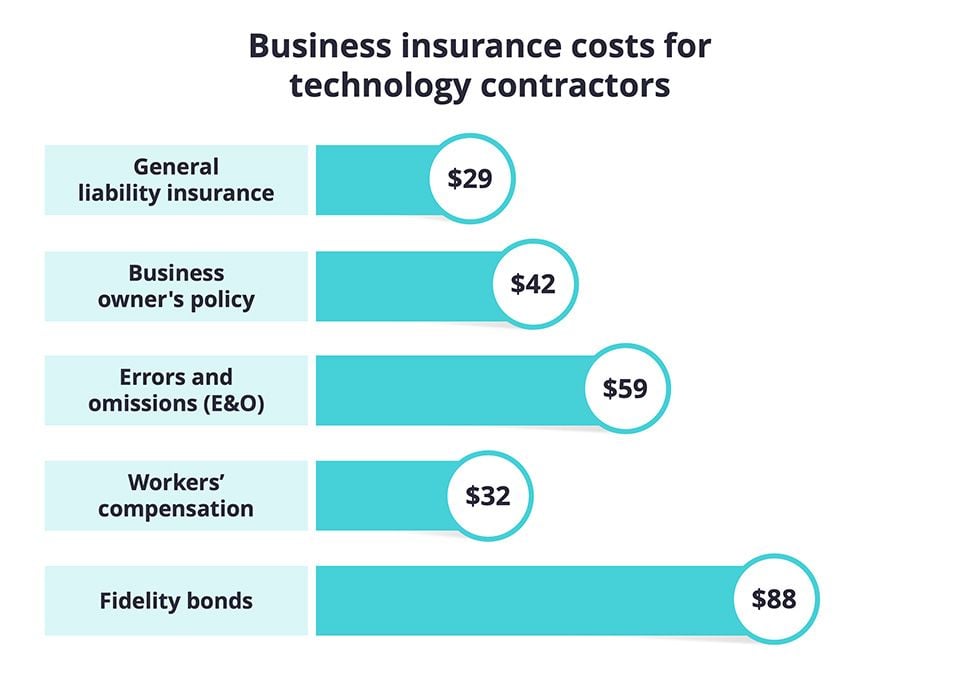

The more policies you need, the more you’ll spend on insurance. Here’s how much independent contractors pay on average for common policies.

General liability insurance costs for independent contractors

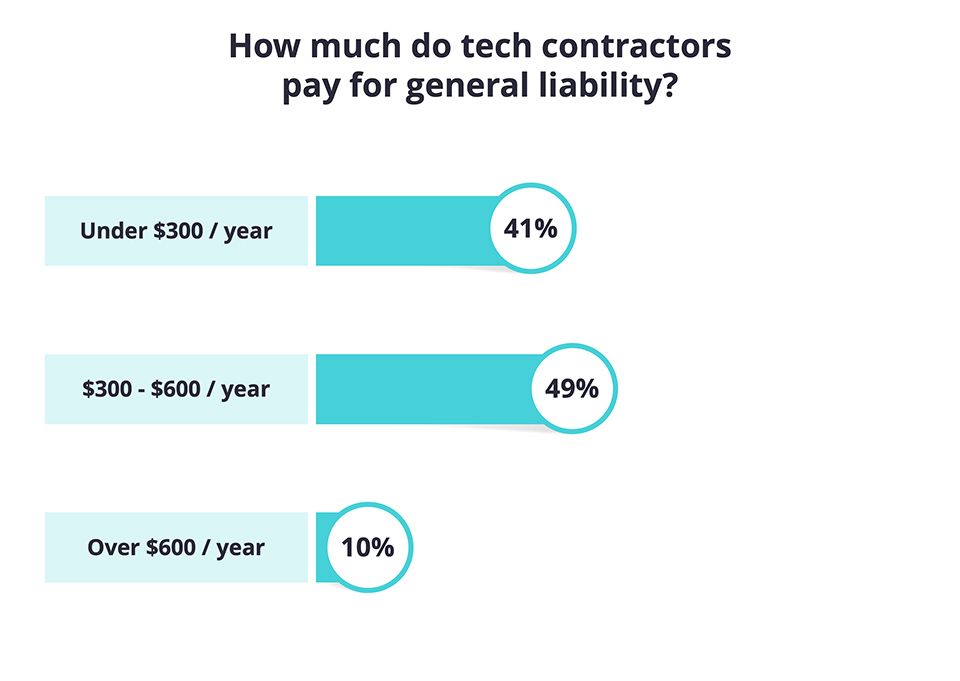

The average cost of general liability insurance for independent contractors is $29 per month, or $344 per year. When combined with commercial property insurance in a business owner’s policy (BOP), independent contractors pay an average of $42 per month, or $500 annually.

General liability insurance covers your legal defense if someone sues over bodily injury, property damage, or defamation. You should consider this policy if you visit clients’ offices, handle other people’s equipment, or are active on social media. Clients may ask to see a certificate of insurance that proves you have this coverage.

Most independent contractors (90%) pay less than $50 per month, or $600 per year, for commercial general liability insurance. As your risk of a lawsuit goes up, so will your premium.

Which general liability limits and deductibles do tech contractors choose?

The majority of tech contractors (89%) choose a general liability insurance policy with a $1 million per-occurrence limit and a $2 million aggregate limit. The average deductible is $500.

The per-occurrence limit is the maximum your insurer will pay on a claim. The aggregate limit is the maximum it will pay during the policy period: usually one year. Choosing higher limits means your insurance company will pay more on a claim, but your policy will cost more.

While you can save money by choosing a higher deductible, make sure it is an amount you can afford.

Technology errors and omissions insurance costs for independent contractors

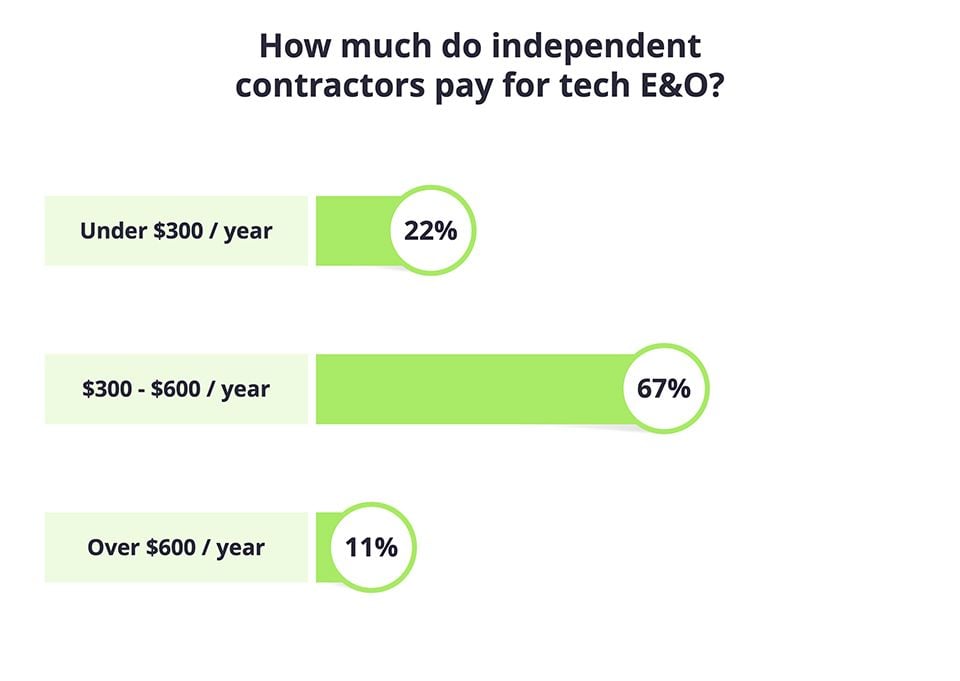

Independent contractors in tech pay an average of $59 per month, or $713 per year, for technology errors and omissions insurance (tech E&O). This package includes both errors and omissions insurance (also called professional liability insurance) and cyber liability insurance.

Tech E&O helps cover costs when a client sues over the quality of your work or blames you for failing to prevent a data breach or cyberattack. That means your premium goes up as your responsibility to clients increases.

Most contractors (89%) can expect to pay less than $100 per month, or $1,200 per year, for this policy.

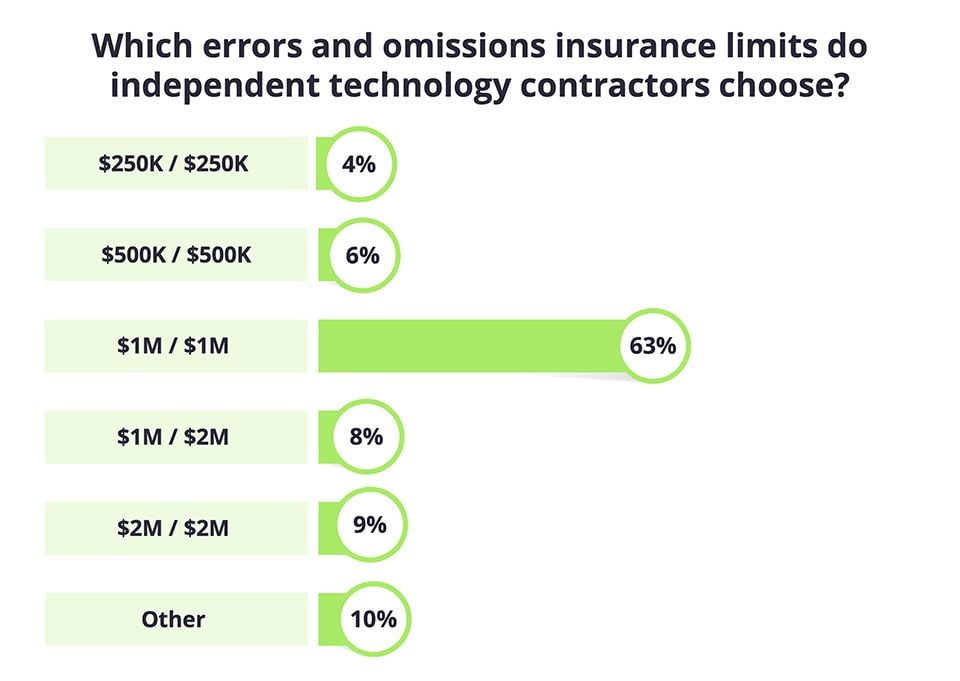

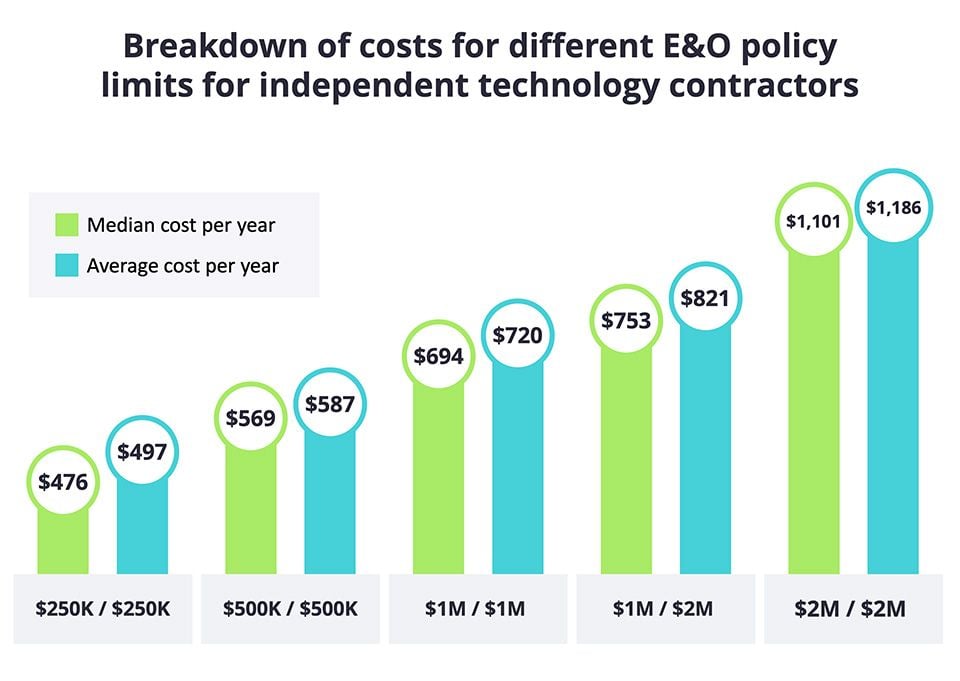

Which tech E&O limits and deductibles do independent contractors choose?

Most independent contractors (63%) choose a tech E&O policy with a $1 million per-occurrence limit and a $1 million aggregate limit. The average deductible is $2,500.

As with your general liability policy, you can adjust your limits and deductible to match your budget and your business needs.

Here are a few examples of independent contractors who should consider higher limits:

- IT consultants whose clients expect their advice to boost profits substantially.

- Cybersecurity professionals charged with securing large amounts of sensitive data.

- Project managers, software developers, and anyone else responsible for deadlines or errors that could cause a client to lose money.

Keep in mind that higher limits always cost more. That’s why you may want to check with a licensed TechInsurance agent to make sure you’re not paying for coverage you don’t need.

As you can see below, you can pay as little as $40 per month ($476 per year) for a tech E&O policy with low limits. Or you can pay more for greater protection if you need it.

Depending on the scale and severity of a cyberattack and the cost of data recovery, settlements or judgments could easily top six figures. Evaluate your business risk to determine how much cyber liability insurance you need.

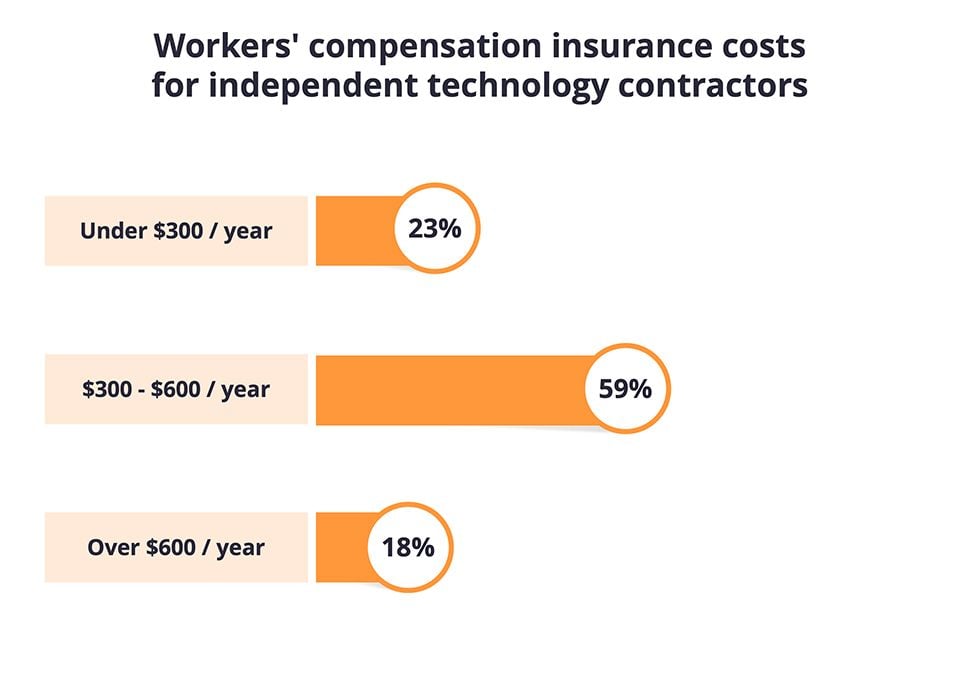

Workers’ compensation insurance costs for independent contractors

Workers’ compensation insurance costs independent contractors an average of $32 per month or $384 per year. Tech companies usually must buy this policy as soon as they hire their first employee.

Most independent contractors (82%) pay less than $600 per year for this policy. The cost depends on the number of employees and the type of work they do for your business.

Why do independent contractors need workers’ compensation?

If you work alone, you don’t have to buy workers’ comp. But given the cost of medical bills, it might be a wise choice. It covers treatment and rehabilitation if you’re injured, along with part of the wages that you lose when you take time off work to recover.

Some of the most common work injuries happen in tech. Here are a few scenarios:

- A computer repair technician could hurt their hand if a screwdriver slips.

- A software developer could get carpal tunnel syndrome after years of typing.

- A data analyst could trip on a power cable and break their arm.

That’s why everyone needs this coverage, not just employees who you consider high risk.

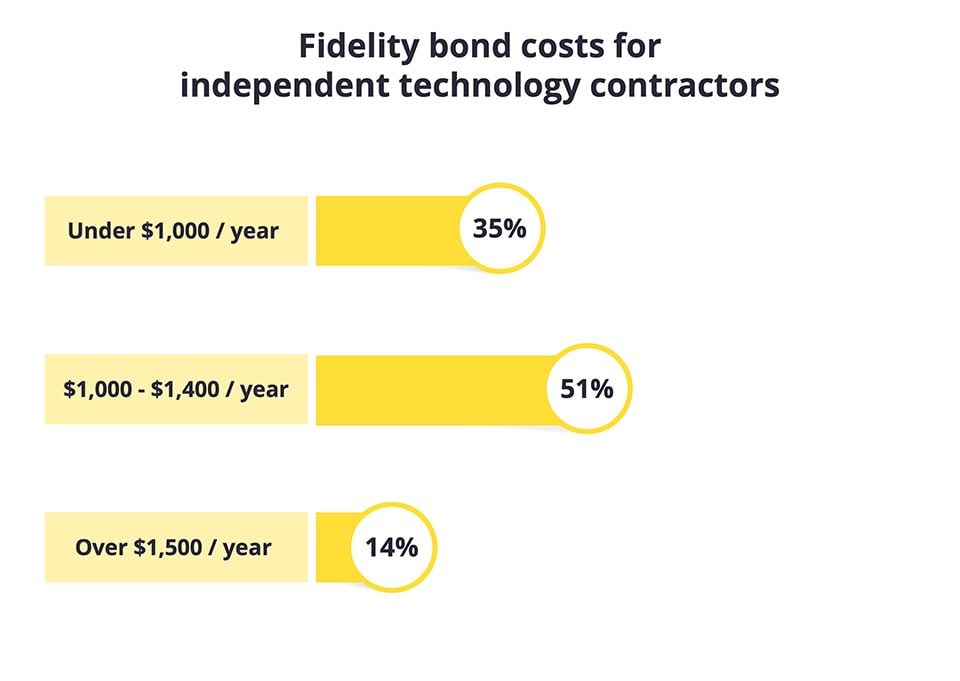

Fidelity bond costs for independent contractors

Independent contractors pay an average of $88 per month or $1,054 per year for fidelity bonds.

Fidelity bonds cover employee theft – so why would you need this policy if you work alone? The answer is that some clients may want you to have this coverage to ensure they will be compensated if you’re dishonest.

Most independent contractors (86%) pay less than $125 per month or $1,500 per year for fidelity bonds.

What do independent contractors pay for other types of insurance?

View our small business insurance cost overview or find out how much you can expect to pay for common types of business insurance.