How much does workers’ compensation insurance cost?

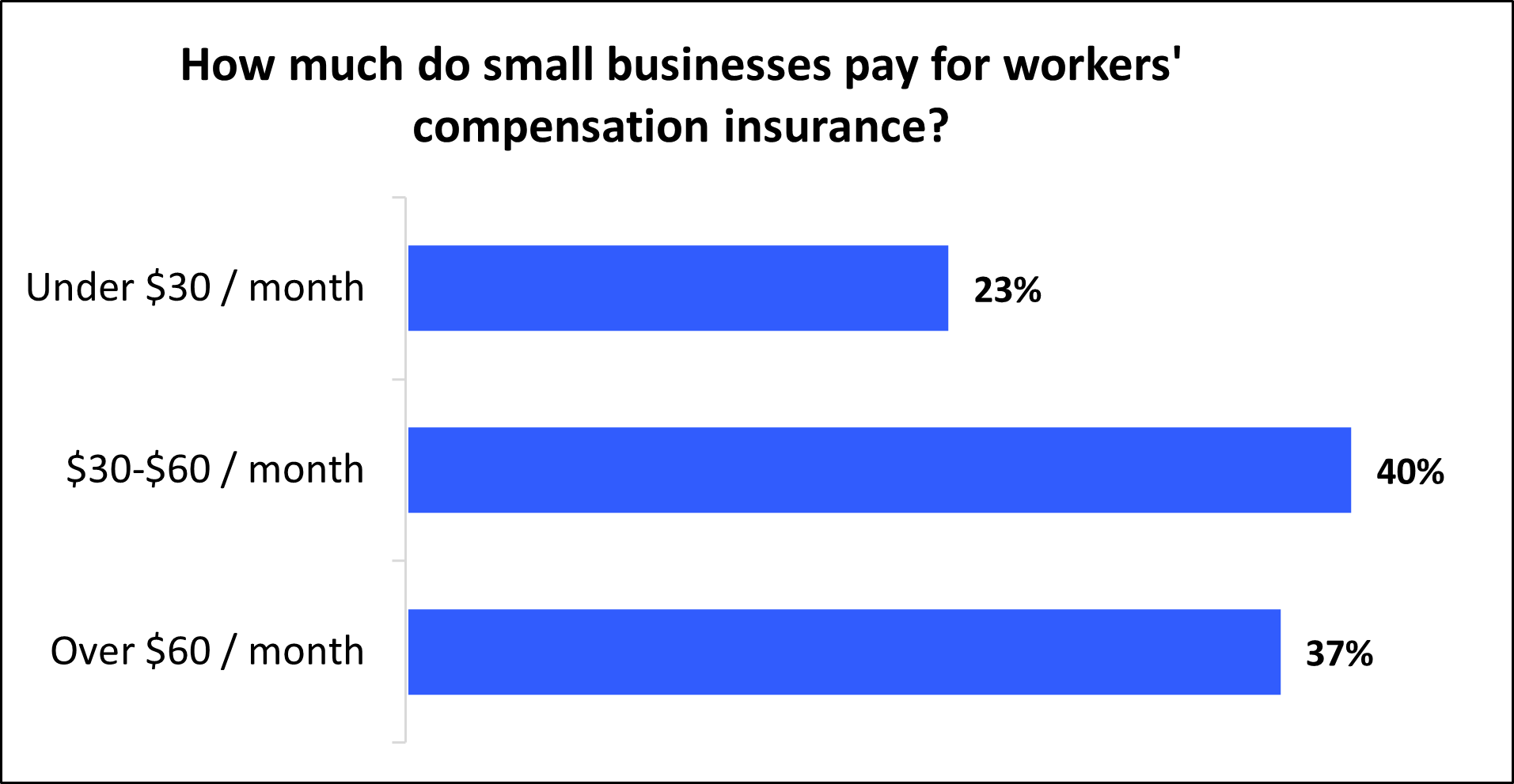

The average premium for workers' compensation insurance is about $45 per month. Your exact cost will depend on several factors, including your policy limits, business location, and number of employees.

What is the average cost of workers' compensation insurance?

On average, workers' compensation insurance costs $45 per month, or about $542 annually. Almost two-thirds (63%) of policyholders can expect to pay under $60 for their workers' compensation insurance coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

How do policy limits impact workers' compensation costs?

Workers’ comp does not have limits for how much it pays out on a covered workplace injury or illness. It typically covers full-time and part-time employees' medical costs, partial wages, and even disability benefits.

However, most workers’ compensation policies include employer’s liability insurance, which does have limits.

Employer’s liability insurance protects you when an employee sues over their injury. For example, a technician at your telecom company could slip and fall, and blame you for an unsafe environment. This policy would cover your legal expenses up to its limits if the case went to court.

Most companies choose a $1 million per-occurrence limit and a $1 million aggregate limit for employer’s liability insurance. If you choose higher limits, expect your workers' comp rate to increase.

What other factors affect workers' compensation insurance costs?

Your coverage limits aren't the only thing that will influence your workers' comp insurance costs.

Your insurance providers will also look at a number of other factors when calculating your premium rates, such as your claims history, number of employees, and location.

How does the type of work your employees do influence cost?

For consistency, most insurance companies use the National Council on Compensation Insurance (NCCI) class code system to determine your level of risk and set workers' compensation insurance rates.

Some jobs are riskier than others. And those who are more likely to get hurt will contribute to costlier workers' compensation insurance premiums.

For example, small business owners pay a higher workers' comp premium to cover employees who work with their hands, like computer repair technicians and telecom installers, than employees who work all day in an office.

Some of the most common injuries can happen in any workplace, such as falls. So, regardless of risk level, be sure that all employees are covered under your workers' compensation policy.

How does your annual payroll impact cost?

The more your employees earn, the higher your workers’ compensation costs. Injured employees can collect partial wages, so your insurance agency will factor your annual payroll costs into your insurance premiums.

How does your claims history affect cost?

Your insurance company will look at your workers’ compensation claims history when it sets your premium.

As part of the calculation, your insurer assigns your company an experience modification factor. This number shows how claims from your company compared to claims from similar companies. If your claims were higher than the norm, you could expect to pay more going forward.

Hoes does your number of employees influence cost?

It's simple: The more employees you have, the more opportunities there are for a worker to get injured and/or file a lawsuit.

Though it may be tempting to cut costs by skipping this coverage when it's not required, even sole proprietors and independent contractors should consider getting workers' comp coverage. The high cost of medical expenses can make it well worthwhile in the long run.

How do state laws and regulations impact cost?

Because workers’ compensation laws are set by each state, where your employees work will determine how much you pay for this policy.

For example, states with strict workers’ compensation regulations, like California or New York, have higher premiums. But you might save money if you live in a state like Texas. Texas has low insurance rates and is one of two states that don't require businesses to carry a workers' comp policy.

Four states (North Dakota, Ohio, Washington, and Wyoming) require business owners to purchase workers' comp from a state fund.

Because these states are monopolistic, they offer small businesses only one option for getting workers' comp coverage. This means the premiums are already well-established and there isn't as much flexibility on cost compared to other states.

Find workers' comp requirements in your state

How can you save money on workers’ compensation insurance?

There are things you can do to keep your workers' compensation rates low.

Some strategies include:

Make annual payments

When you purchase a workers’ compensation insurance policy, you can pay your premium in annual or monthly installments. The annual option costs less than paying every month.

Classify your employees correctly

When assigning a classification code to an employee, be sure you are assigning the right one.

Not only will this help you avoid misclassification fines, but assigning correct codes will help prevent unnecessary overpaying. For example, employees with desk jobs or other jobs with a low risk of injury cost less to insure than high-risk professions.

Focus on workplace safety

Business owners can avoid claims and keep rates low by taking steps to reduce work-related injuries.

This includes:

- Training employees on safe lifting techniques

- Mopping up spills promptly to prevent falls

- Removing clutter and tape down loose cables

- Providing ergonomic setups to avoid injuries like carpal tunnel syndrome

Obtain a "pay-as-you-go" insurance policy

For some small businesses, getting a pay-as-you-go workers' comp policy is an easy way to save money. This type of coverage offers flexible premiums that change throughout the annual year, depending on how your number of employees and payroll data fluctuate during a 12-month span.

Get a minimum premium workers' compensation policy

If your small business has few risks and a small number of employees, you may be eligible for a minimum premium workers' compensation policy. This type of workers' comp policy sets your premium charges at the minimum premium (i.e., the smallest amount of money that an insurance company will sell to a business).

For independent contractors, sole proprietors, and other business owners who don't have any employees, you might be eligible for a type of minimum premium policy called a workers' comp ghost policy.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated insurance carriers, buy policies based on your business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free workers' comp quotes from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.